Qo'shma Shtatlardagi savdo soliqlari - Sales taxes in the United States

Qo'shma Shtatlardagi savdo soliqlari yilda tovarlar va xizmatlarni sotish yoki ijaraga berish uchun joylashtirilgan soliqlardir Qo'shma Shtatlar. Savdo solig'i davlat darajasida tartibga solinadi va milliy general yo'q savdo solig'i mavjud. 45 shtatlar, Kolumbiya okrugi, Puerto-Riko hududlari va Guam ko'pgina tovarlarni sotish yoki ijaraga berish va ba'zi xizmatlarga nisbatan qo'llaniladigan umumiy savdo soliqlarini to'laydilar, shuningdek shtatlar ma'lum tovarlarni sotish yoki ijaraga berish uchun tanlangan savdo soliqlarini olishlari mumkin. yoki xizmatlar. Shtatlar mahalliy boshqaruv organlariga qo'shimcha umumiy yoki tanlab sotish uchun soliqlarni qo'llash vakolatini berishi mumkin.

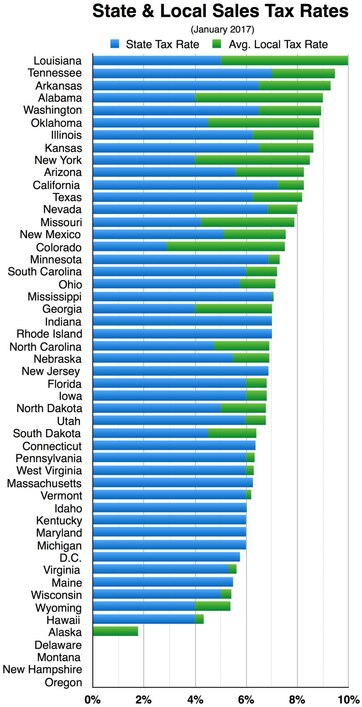

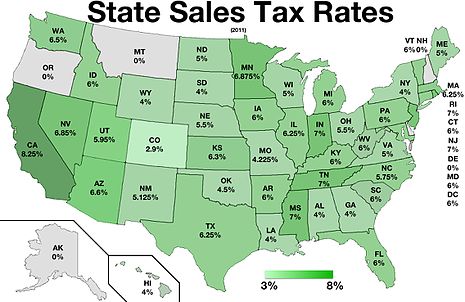

2017 yilga kelib, 5 ta shtat (Alyaska, Delaver, Montana, Nyu-Xempshir va Oregon) shtat bo'ylab sotishdan soliq undirmaydi.[1] Kaliforniya sotish bo'yicha eng yuqori soliq stavkasiga ega, 7,25%. Tuman va shahar savdo soliqlarini hisobga olgan holda, eng yuqori savdo solig'i yig'indisi Arab, Alabama, 13.50%.[2]

Savdo solig'i sotib olish narxini amaldagi soliq stavkasiga ko'paytirish yo'li bilan hisoblanadi. Sotuvchi uni sotish paytida yig'adi. Soliqdan foydalaning soliqqa tortiladigan xarid uchun savdo solig'ini to'lamagan xaridor tomonidan o'zini o'zi baholaydi. Dan farqli o'laroq qo'shilgan qiymat solig'i, savdo solig'i faqat chakana savdo Daraja. Agar buyumlar, masalan, ishlatilgan avtomashinalar kabi bir necha marotaba chakana savdoda sotilgan bo'lsa, savdo solig'i o'sha buyumdan cheksiz ravishda olinishi mumkin.

Shtatlarda chakana savdo va soliq solinadigan narsalarning ta'riflari turlicha. Deyarli barcha yurisdiktsiyalar savdo soliqlaridan ozod qilingan yoki arzonlashtirilgan stavkalar bo'yicha soliq solinadigan ko'plab tovar va xizmatlarning toifalarini taqdim etadi. Keyinchalik ishlab chiqarish yoki qayta sotish uchun tovarlarni sotib olish, sotish soliqlaridan bir xilda ozod qilinadi. Ko'pgina yurisdiktsiyalar oziq-ovqat do'konlarida sotiladigan oziq-ovqat, retsept bo'yicha dori-darmonlar va ko'plab qishloq xo'jaligi materiallaridan ozod qilinadilar.

Sotish bo'yicha soliqlar, shu jumladan mahalliy hokimiyat organlari tomonidan qo'llaniladigan soliqlar, odatda, davlat darajasida boshqariladi. Savdo solig'i soladigan davlatlar yoki chakana sotuvchilarga soliq soladilar, masalan, Arizonadagi bitim imtiyozlari solig'i bilan,[3] yoki uni chakana xaridorlarga yuklash va sotuvchilardan uni to'plashni talab qilish. Ikkala holatda ham sotuvchi deklaratsiyani topshiradi va soliqni davlatga qaytaradi. Soliq sotuvchiga tegishli bo'lgan shtatlarda sotuvchi xaridorga uning o'rnini qoplashni talab qilishi odatiy holdir. Protsessual qoidalar juda xilma-xil. Sotuvchilar, odatda, xaridor imtiyoz sertifikatini taqdim qilmasa, shtat ichidagi xaridorlardan soliq yig'ishi kerak. Ko'pgina davlatlar elektron pul o'tkazmalariga ruxsat berishadi yoki talab qilishadi.

Soliq solinadigan narsalar

Sotishdan olinadigan soliqlar faqat undiriladi soliq solinadigan tovarlar yoki xizmatlarni o'tkazish. Soliq, soliq stavkasi soliq solinadigan operatsiya qiymatiga nisbatan soliq stavkasi sifatida hisoblanadi. Stavkalar shtat va shtat hududiga qarab farqlanadi.[5] Barcha turdagi o'tkazmalar soliqqa tortilmaydi. Soliq iste'molchilarga va korxonalarga sotishdan olinishi mumkin.[6]

Soliq solinadigan savdo

Moddiy shaxsiy mol-mulkni naqd pulga o'tkazishda yoki naqd pulni to'lashda va'da berishda (sotishda) ko'pincha istisnolardan tashqari, savdo solig'i olinadi.[7] Savdo solig'i ko'chmas mulk o'tkazmalariga taalluqli emas, ammo ba'zi davlatlar bunday ko'chirmalarga ko'chmas mulk ko'chirilishini yoki hujjatli soliqni belgilaydilar. Barcha shtatlar ulgurji sotish uchun, ya'ni qayta sotish uchun sotish uchun soliqdan ba'zi bir imtiyozlarni taqdim etadi.[8] Biroq, ba'zi davlatlar savdo avtomatlari orqali qayta sotish uchun sotishdan soliq to'laydilar.[9]

Sovg'a kartalarini sotib olish barcha shtatlarda savdo solig'iga tortilmaydi. Ushbu xaridlar naqd pulni almashtirishga o'xshash deb hisoblanadi. Sovg'a kartalari soliq solinadigan tovarlar yoki xizmatlar uchun to'lov usuli sifatida foydalanilganda savdo solig'i olinadi. Nyu-York shtatida sovg'a kartasi ishlatilganda uning o'rniga sovg'a kartasini sotib olayotganda savdo solig'ini qo'llash taklifi bor edi, ammo u muvaffaqiyatsiz tugadi.[10]

Ko'pgina shtatlar, shuningdek, butun biznesni sotish kabi ommaviy sotishdan ozod qiladilar. Aksariyat davlatlar keyingi ishlab chiqarishda tarkibiy qism yoki qism sifatida foydalanish uchun sotib olingan tovarlarni sotishdan ozod qiladi. Sotishdan ozod bo'lgan xaridorlar ma'lum tartib-qoidalarga rioya qilishlari yoki soliqqa tortilishi kerak.

Korxonalarga va iste'molchilarga sotishdan, odatda, avvalgi xatboshida qayd etilgan hollar bundan mustasno. Korxonalar o'zlarining xaridlari uchun savdo soliqlarini yig'ish va to'lov majburiyatlari uchun hech qanday kompensatsiya olmaydi. Bu qo'shimcha qiymat soliqlaridan sezilarli darajada farq qiladi.

Sotish joyi va usuli ma'lum tovarlarni sotishda soliqqa tortiladimi-yo'qligiga ta'sir qilishi mumkin. Ko'pgina davlatlar oziq-ovqat mahsulotlarini bino ichidagi iste'mol uchun soliqqa tortadilar, lekin bino tashqarisida iste'mol qilish uchun sotiladigan oziq-ovqat mahsulotlariga emas[11] Tovarlar qo'yiladigan foydalanish, shuningdek, sotish soliqqa tortiladimi-yo'qligiga ta'sir qilishi mumkin. Ishlab chiqarishda tarkibiy qism sifatida ishlatiladigan tovarlar soliqdan qochishi mumkin, agar etkazib berish bilan bir xil tovarlar olinmasa.[12]

Ijaraga berish

Ko'pgina shtatlar moddiy shaxsiy mol-mulkni ijaraga berishda soliq to'lashadi. Ko'pincha soliq mol-mulk qo'yiladigan foydalanishga bog'liq emas. Faqat Florida tijorat ko'chmas mulki ijarasi uchun savdo solig'ini oladi.

Ozod qilingan tashkilotlar

Ko'pgina shtatlar ozod qilingan xayriya, diniy va boshqa ba'zi tashkilotlar ushbu tashkilot foydalanishi uchun sotib olingan tovarlarga sotishdan yoki ulardan foydalanadigan soliqlardan.[13] Odatda bunday imtiyoz tashkilot tomonidan olib boriladigan savdo yoki biznesga taalluqli emas.[14]

Soliqdan foydalaning

Sotish uchun soliq to'laydigan davlatlar, shuningdek, soliq solinadigan mol-mulk yoki xizmatlarni xaridorlariga o'xshash soliqni sotish soliqlari to'lanmagan hollarda ham o'rnatadilar. Foydalanish soliqlari funktsional ravishda sotish soliqlariga tengdir. Sotish va foydalanishga solinadigan soliqlar birgalikda yig'ilib, "sotib olinadigan joyidan qat'i nazar, barcha moddiy shaxsiy mulklarni sotishda yoki ulardan foydalanishda yagona soliqni ta'minlaydi."[15] Ba'zi davlatlar sotib olingan tovarlar bo'yicha boshqa shtatlarda to'langan savdo soliqlarini soliq to'lovchining shtatidagi foydalanishga solinadigan soliqqa nisbatan hisobga olishga ruxsat beradi.[16]

Soliq solinadigan qiymat

Savdo solig'i solinadigan summa odatda sof savdo narxidir. Bunday narx odatda amaldagi chegirmalardan so'ng amalga oshiriladi.[17]

Ba'zi davlatlar tovarlarning ayrim toifalari uchun sotish yoki sotib olish narxining bir qismini soliqdan ozod qiladilar.[18]

Soliq solinadigan tovarlar

Hech bir davlat barcha turdagi tovarlarga sotishdan soliq undirmaydi. Shtat qonunlari qanday tovarlarga soliq solinishi borasida juda xilma-xil. Uyda tayyorlash va iste'mol qilish uchun oziq-ovqat ko'pincha soliqqa tortilmaydi,[19] na retsept bo'yicha dorilar. Aksincha, restoran taomlari ko'pincha soliqqa tortiladi.[20]

Ko'pgina davlatlar tovarlarning ayrim o'ziga xos turlari uchun imtiyozlar beradi, boshqa turlari uchun emas. Oziq-ovqat mahsulotlarining ayrim turlari, hatto uy iste'mol qilish uchun oziq-ovqat do'konida sotilganda ham, soliq solinadigan soliqlardan ozod qilinishi mumkin.[21] Qaysi tovarlarga soliq solinadigan va nimaga yaroqsiz bo'lgan ro'yxatlar katta bo'lishi mumkin.[22]

Xizmatlar

Aksariyat shtatlar ba'zi xizmatlardan soliq to'laydi, ayrim shtatlar esa ko'plab xizmatlardan soliq to'laydi. Biroq, xizmatlardan soliqqa tortish qoidadan ko'ra istisno hisoblanadi.[23] Shifokorlar, stomatologlar yoki advokatlarning xizmatlaridan soliq to'laydigan davlatlar kam. Moddiy shaxsiy mulkni sotish bilan bog'liq xizmatlar ko'pincha soliqqa tortiladi. Ammo aksariyat shtatlar soliq xizmatlari, masalan, bosmaxona yoki shkaf ishlab chiqarish kabi tovarlarni ishlab chiqarishning ajralmas qismi hisoblanadi.[24]

Telekommunikatsiya xizmatlari aksariyat shtatlarda savdo solig'iga o'xshash soliqqa tortiladi. Faqat bir nechta davlatlar Internetga kirish yoki boshqa axborot xizmatlaridan soliq to'laydilar. Qurilish xizmatlari davlatlar tomonidan kamdan-kam soliqqa tortiladi. Ko'chmas mulk qurilishida foydalaniladigan materiallar quruvchiga, subpudratchiga yoki qurilish bilan shug'ullanuvchi shaxsga sotishdan olinadigan soliqqa tortilishi mumkin yoki sotish solig'idan to'liq ozod bo'lishi mumkin.

Nomoddiy mulk

Sotish to'g'risidagi qonunlarning aksariyati nomoddiy mol-mulk uchun to'lovlarning ko'pchiligida qo'llanilmaydi. Ba'zi shtatlar nomoddiy mulkni ko'chirish yoki litsenziyalarning ayrim shakllariga soliq soladilar. Sotishdan olinadigan soliqqa tortiladigan umumiy bitim - bu "shrink wrap" dasturining litsenziyasi.[25] Shtat sudlari ko'pincha moddiy bo'lmagan huquqlarning ko'plab o'tkazmalari, agar ular maxsus ozod qilinmagan bo'lsa, savdo solig'i solinishi kerak deb hisoblanishini aniqladilar.[26]

Qayta sotish uchun sotish

Barcha davlatlar bir xil shaklda qayta sotish uchun qilingan tovarlarni sotishdan ozod qilinadilar yoki soliq sotib olishdan foydalanadilar.[27] Ko'pgina shtatlarda qayta sotish sotib olingan mulkni ijaraga olishni o'z ichiga oladi. Agar sotib olingan mol-mulk aynan qayta sotilmagan bo'lsa, sotib olish soliqqa tortilishi mumkin. Bundan tashqari, sotishdan oldin mol-mulkdan foydalanish qayta sotish imtiyozini bekor qilishi mumkin.[28] Bepul tarqatish uchun sotib olingan tovarlar, boshqa davlatlarda emas, balki ba'zi shtatlarda sotib olish uchun soliqqa tortilishi mumkin.[29]

Moddiy shaxsiy mulkni ishlab chiqarishda tarkibiy qism sifatida foydalanish uchun sotib olingan tovarlar odatda soliqqa tortilmaydi. Restoranlarning oziq-ovqat mahsulotlarini sotib olishlari, odatda, tarkibiy qismlar o'zgarganiga qaramay, restoranlarning sotishlariga soliq soladigan davlatlarda soliqqa tortilmaydi. Mashinalarning bir qismi sifatida sotib olingan po'latdan odatda soliq olinmaydi. Biroq, xuddi shu korxonalar tomonidan iste'mol qilinadigan materiallar soliqqa tortilishi mumkin. Mezonlar har xil shtatlarda farq qiladi.[30]

Xizmatlarni bajarish doirasida taqdim etiladigan tovarlarni sotib olishga soliq solinishi mumkin. Aviakompaniyalar va mehmonxonalarga xizmatlari doirasida taqdim etiladigan oziq-ovqat mahsulotlarini sotib olish, masalan, parvoz paytida ovqatlanish yoki bepul nonushta kabi soliq solinishi mumkin.[31] Agar bunday tovarlar uchun alohida to'lov olinadigan bo'lsa, ularni qayta sotish uchun sotib olingan deb hisoblash mumkin.[32]

Sotib olinmaydigan narsalardan tovarlarni farqlash

Xizmatlar va moddiy bo'lmagan narsalarga odatda soliq solinmasligi sababli, moddiy mulkni soliqqa tortiladigan sotish bilan soliq to'lamaydigan xizmat yoki nomoddiy transfert o'rtasidagi tafovut qarama-qarshiliklarning asosiy manbai hisoblanadi.[33] Ko'pgina davlat soliq ma'murlari va sudlari bitimning "haqiqiy ob'ekti" yoki "dominant maqsadi" ga qarashadi, bu soliq solinadigan savdo-sotiq ekanligini aniqlash uchun.[34] Ba'zi sudlar mulkning ahamiyatini ko'rsatilayotgan xizmatlarga nisbatan ko'rib chiqdilar.[35] Agar mol-mulk xizmat ko'rsatish shartnomasi bilan sotilgan bo'lsa (masalan, kengaytirilgan kafolat yoki xizmat shartnomasi), xizmat shartnomasi, agar uni alohida sotib olish mumkin bo'lsa, odatda alohida sotish sifatida qaraladi. Michigan va Kolorado sudlari muayyan bitim uchun turli xil omillarni ko'rib chiqishda yanada yaxlit yondashuvni qo'lladilar.

To'lov, to'lov va soliq deklaratsiyalari

Savdo soliqlari aksariyat shtatlarda sotuvchilar tomonidan yig'iladi. Foydalanish uchun soliqlarni xaridorlar o'zlari hisoblashadi. Ko'pgina shtatlar muntazam ravishda savdo-sotiq bilan shug'ullanadigan jismoniy va yuridik shaxslardan davlat ro'yxatidan o'tishni talab qiladi. Savdo solig'ini qo'llaydigan barcha davlatlar yig'ilgan soliqlarni kamida uch oyda bir marta davlatga to'lashni talab qiladi. Aksariyat shtatlarda chegara bor, unda tez-tez to'lov talab etiladi. Ba'zi davlatlar yig'ilgan soliqni to'lashdan keyin sotuvchilarga chegirma beradi.

Ba'zi shtatlarda yig'ilgan savdo soliqlari davlatga tegishli bo'lgan pul hisoblanadi va sotuvchini soliqni to'lamaganligi uning ishonchli vazifalarini buzgan deb hisoblaydi. Soliq solinadigan mol-mulkni sotuvchilar har qanday yurisdiktsiya bo'yicha soliq deklaratsiyasini topshirishlari shart, ular sotishdan olinadigan soliqni undirishlari kerak. Aksariyat yurisdiktsiyalar deklaratsiyani har oyda topshirilishini talab qiladi, ammo kam miqdordagi soliq to'lashga majbur bo'lgan sotuvchilarga kamroq tez-tez murojaat qilishlari mumkin.

Sotish bo'yicha soliq deklaratsiyalari odatda barcha sotishlar, soliq solinadigan sotishlar, ozod qilish toifalari bo'yicha sotuvlar va soliq miqdori to'g'risida xabar beradi. Bir nechta soliq stavkalari (masalan, sotilgan mulkning turli toifalariga nisbatan) belgilanadigan bo'lsa, ushbu summalar odatda har bir stavka bo'yicha hisobot qilinadi. Ba'zi bir davlatlar davlat va mahalliy savdo soliqlari bo'yicha deklaratsiyalarni birlashtiradilar, ammo ko'plab mahalliy yurisdiktsiyalar alohida hisobot berishni talab qiladi. Ba'zi yurisdiktsiyalar deklaratsiyalarni elektron shaklda topshirishga ruxsat beradi yoki talab qiladi.

O'z yurisdiksiyasida savdo solig'ini to'lamagan tovarlarni sotib oluvchilar soliqqa tortiladigan xaridlar to'g'risida hisobot berish uchun soliq deklaratsiyasini topshirishlari shart. Ko'pgina davlatlar jismoniy shaxslar uchun shaxsiy daromad solig'i deklaratsiyasining bir qismi sifatida bunday hujjatlarni rasmiylashtirishga ruxsat berishadi.

Imtiyoz sertifikatlari

Xaridorlar sotuvchiga sotib olish soliqdan ozod qilinganligi to'g'risidagi sertifikatni taqdim qilmasa (soliqdan ozod qilish to'g'risidagi guvohnoma), xaridorlar savdo solig'ini to'lashlari shart. Sertifikat davlat tomonidan tasdiqlangan shaklda bo'lishi kerak. 38 ta davlatdan foydalanishni tasdiqlagan Ko'p davlatli soliq komissiyasi Sotish va foydalanish bo'yicha yagona guvohnoma.

Istisnolar odatda ikkita toifaga bo'linadi: foydalanishga asoslangan yoki mavjudlikka asoslangan. Boshqa turdagi soliq solinadigan ob'ekt yoki xizmatlardan ozod qilingan deb hisoblanadigan tarzda foydalanilganda, imtiyozlardan foydalanish. Qayta sotishdan ozod qilish eng keng tarqalgan foydalanishga asoslangan ozod qilishdir. Ishlab chiqarishda, tadqiqotlarda va ishlanmalarda yoki teleproductsiyada ishlatilishi mumkin bo'lgan boshqa narsalar foydalanishga asoslangan imtiyozlar bo'lishi mumkin. Tashkilotga asoslangan imtiyozlar, agar buyum yoki xizmat faqat xaridor davlat tomonidan ozod qilingan maqom bergan toifaga kirganligi sababli ozod qilingan bo'lsa. Davlat organlari (federal, shtat yoki mahalliy), notijorat tashkilotlari, diniy tashkilotlar, qabilaviy hukumatlar yoki chet el diplomatlari ozod qilinishi mumkin. Har qanday davlat qaysi asosda va yuridik shaxslar tomonidan qanday imtiyozlar berishini o'zi hal qiladi.

Penaltilar

Sotuvni topshirishi yoki soliq deklaratsiyasidan foydalanishi shart bo'lmagan shaxslar jarimaga tortiladi. Sotuvni to'g'ri to'lamagan va belgilangan muddatda soliqdan foydalanmagan shaxslar ham jarimaga tortilishadi. Jazolar to'lanmagan soliq summasiga asoslangan bo'lib, yurisdiksiyaga qarab farqlanadi.

Soliq tekshiruvlari

Savdo soliqlarini belgilaydigan barcha davlatlar sotuvlarni tekshiradilar va har yili ko'plab soliq to'lovchilarning deklaratsiyalaridan foydalanadilar. Bunday tekshiruvdan so'ng davlat to'lashi kerak bo'lgan soliq miqdorini o'zgartirishni taklif qilishi mumkin. Soliq to'lovchilar sud vakolatiga ko'ra farq qiladigan apellyatsiya shikoyatlarining ma'lum huquqlariga ega. Ba'zi shtatlar sud shikoyati oldidan soliq to'lashni talab qiladilar va ba'zi davlatlar soliq to'lashni soliq majburiyatini tan olish deb hisoblashadi.

Konstitutsiyaviy cheklovlar

Hozir bekor qilingan ikkita Oliy sud qaroriga binoan, Quill Corp., Shimoliy Dakota (1967) va National Bellas Hess va Illinoysga qarshi (1992), shtatlarda davlatda jismoniy ishtiroki yoki "aloqasi" bo'lmagan sotuvchilardan, masalan, shirkatlardan savdo solig'ini undirish taqiqlangan. pochta orqali buyurtma, onlayn xarid qilish va uyda xarid qilish telefon orqali. Ba'zi davlatlar xaridorlardan har bir tranzaksiya uchun bir xil miqdorda haq olishga harakat qilishadi soliqdan foydalanish o'rniga, lekin ijro etilish qiyinligi sababli muvofiqlik nisbatan past. 2018 yil iyun oyidagi qaror Janubiy Dakota va Wayfair ning ushbu talqinini bekor qildi Savdo qoidalari, iste'molchilar shtatda bo'lganida, shtatlarga tegishli bo'lmagan savdogarlardan savdo soliqlarini yig'ish uchun shtatlarga ruxsat berish.

Bir nechta davlat konstitutsiyalari savdo solig'i bo'yicha cheklovlarni joriy etadi. Ushbu cheklovlar oziq-ovqat kabi ba'zi bir narsalarga soliq solishni cheklaydi yoki taqiqlaydi.[36]

Yurisdiktsiya bo'yicha

Sotishdan olinadigan soliq stavkalari va soliqqa tortiladigan narsalar yurisdiktsiyaga qarab farq qiladi. Quyidagi jadvalda shtatlarning tanlangan toifadagi tovarlariga soliq solishtirilib berilgan. Boshqa muhim farqlar amal qiladi. Jadvaldan keyin tanlangan savdo solig'i stavkalarining davlat tomonidan qisqartirilgan yoritilishi.[37][38]

Xulosa jadvali

| Rang | Izoh |

|---|---|

| Umumiy savdo solig'idan ozod qilingan | |

| Umumiy savdo solig'i bo'yicha | |

| 7% | Umumiy stavkadan yuqori stavka bo'yicha soliqqa tortiladi |

| 3% | Umumiy stavkadan past stavka bo'yicha soliqqa tortiladi |

| 3%+ | Ba'zi joylar ko'proq soliq to'laydi |

| 3% (maksimal) | Ba'zi joylarda soliq kamroq |

| > $50 | $ 50 dan yuqori soliqqa tortilgan xaridlar (aks holda ozod qilinadi) |

| Shtat bo'yicha umumiy savdo solig'i yo'q |

| Shtat federal okrug yoki hudud | Asosiy savdo solig'i | Jami maksimal bilan mahalliy soliq | Oziq-ovqat mahsulotlari | Tayyorlangan ovqat | Retsept dori | Retseptsiz dori | Kiyim | Nomoddiy narsalar |

|---|---|---|---|---|---|---|---|---|

| Alabama | 4% | 13.5% | ||||||

| Alyaska | 0% | 7% | ||||||

| Arizona | 5.6% | 10.725% | ||||||

| Arkanzas | 6.5% | 11.625% | 0.125%+ | |||||

| Kaliforniya | 7.25% | 10.5% | ||||||

| Kolorado | 2.9% | 10% | ||||||

| Konnektikut | 6.35% | 6.35% | 1% | |||||

| Delaver | 0% | 0% | ||||||

| Kolumbiya okrugi | 5.75% | 5.75% | 10% | |||||

| Florida | 6% | 7.5% | 9% (maksimal) | |||||

| Gruziya | 4% | 8% | 4% (maksimal)[39] | |||||

| Guam | 4% | 4% | ||||||

| Gavayi | 4.166% | 4.712% | ||||||

| Aydaho | 6% | 8.5% | [40] | |||||

| Illinoys | 6.25% | 10.25% | 1%+ | 8.25%+ | 1%+ | 1%+ | ||

| Indiana | 7% | 7% | 9% (maksimal) | |||||

| Ayova[41] | 6% | 7% | ||||||

| Kanzas | 6.5% | 11.5% | ||||||

| Kentukki | 6% | 6% | ||||||

| Luiziana | 4.45% | 11.45% | 7.0% (maksimal) | |||||

| Meyn | 5.5% | 5.5% | 8% | |||||

| Merilend | 6% | 6% | ||||||

| Massachusets shtati | 6.25% | 6.25% | 7% (maksimal) | > $175 | ||||

| Michigan | 6% | 6% | ||||||

| Minnesota | 6.875% | 7.875% | 10.775% (maksimal) | |||||

| Missisipi | 7% | 7.25% | ||||||

| Missuri | 4.225% | 10.85% | 1.225% | |||||

| Montana | 0% | 0% | ||||||

| Nebraska | 5.5% | 7.5% | 9.5% (Omaha) | |||||

| Nevada | 6.85% | 8.25% | ||||||

| Nyu-Xempshir | 0% | 0% | 9% | |||||

| Nyu-Jersi | 6.625% | 12.625% | ||||||

| Nyu-Meksiko | 5.125% | 8.688% | ||||||

| Nyu York | 4% | 8.875% | > $110 | |||||

| Shimoliy Karolina | 4.75% | 7.50% | 2% | 8.50% (maksimal) | ||||

| Shimoliy Dakota [42] | 5% | 8% | ||||||

| Ogayo shtati[43] | 5.75% | 8% | Ovqatlanish | |||||

| Oklaxoma | 4.5% | 11% | ||||||

| Oregon | 0% | 0% | ||||||

| Pensilvaniya | 6% | 8% | ||||||

| Puerto-Riko | 10.5% | 11.5% | 1% | |||||

| Rod-Aylend | 7% | 7% | 8% | > $250 | ||||

| Janubiy Karolina | 6% | 9% | 10.5% | |||||

| Janubiy Dakota | 4% | 6% | ||||||

| Tennessi | 7% | 9.75% | 4%+ | |||||

| Texas | 6.25% | 8.25% | ||||||

| Yuta | 5.95% | 8.35% | 3% | |||||

| Vermont | 6% | 7% | 9%+ | |||||

| Virjiniya | 5.3% | 6% | 2.5% | 5.3%+ | ||||

| Vashington | 6.5% | 10.4% | 10% (maksimal) | |||||

| G'arbiy Virjiniya | 6% | 7% | ||||||

| Viskonsin | 5% | 6.75% | ||||||

| Vayoming | 4% | 6% |

Izohlar:

- Ushbu shtatlar oziq-ovqat mahsulotlariga soliq to'laydilar, ammo kambag'al uy xo'jaliklarini: Gavayi, Aydaho, Kanzas, Oklaxoma, Janubiy Dakota va Vayomingni qoplash uchun daromad solig'i bo'yicha imtiyoz berishadi.

- Yagona mahalliy soliqlar Kaliforniya va Yuta (1,25%) va Virjiniyada (1,0%) asosiy stavkaga kiritilgan.

Alabama

Alabama 4% davlat umumiy savdo solig'iga, shuningdek, har qanday qo'shimcha mahalliy shahar va tuman soliqlariga ega.[44] 2015 yil avgust holatiga ko'ra[yangilash], Alabamadagi umumiy savdo soliqlarining eng yuqori umumiy stavkasi qismlarga to'g'ri keladi Arab ular ichida Kullman okrugi Bu jami 13,5% ni tashkil etdi.[45] Alabama - so'nggi uchtadan biri [46]davlatlar oziq-ovqat mahsulotlarini to'liq sotishdan olinadigan davlat soliq stavkasi bo'yicha soliqqa tortishadi, bu esa ozchiliklar va kichik bolali kam ta'minlangan oilalarga nomutanosib ta'sir qiladi.[47]

Shahar soliq stavkalari

- Montgomeri umumiy savdo solig'i 10%,[48] xuddi shunday Birmingem[49][50] va Mobil.

- Xantsvill Madison okrugida joylashgan shaharning ko'p qismida umumiy savdo solig'i 9% ni tashkil qiladi. Xantvillning ohaktosh okrugidagi kichik qismi 10,5% savdo solig'iga ega, chunki 2% yuqori ohaktosh okrugining savdo solig'i. Bu faqat I-565 xizmat ko'rsatish yo'lidagi bir nechta chakana savdo korxonalariga ta'sir qiladi.

- Dekatur shaharning ko'pgina cheklovlarida 9% umumiy savdo solig'iga ega, ammo shaharning yuqori soliqlari tufayli shaharning Ohaktosh okrugidagi kichik qismida 10% umumiy savdo solig'i mavjud.

Alyaska

Davlat savdo solig'i yo'q Alyaska;[51] ammo, mahalliy hukumatlar - o'z ichiga oladi tumanlar, ning Alyaska ekvivalenti okruglar va munitsipalitetlar - 7,5 foizgacha undirilishi mumkin. 2009 yil yanvar holatiga ko'ra, ulardan 108 nafari buni qilmoqda.[52] Mahalliy savdo soliqlari, agar mavjud bo'lsa, shahar savdo soliqlaridan tashqari olinadi. Qoidalar va imtiyozlar shtat bo'ylab juda farq qiladi.[53] Ikki yirik shahar, Anchorage va Feyrbanks, mahalliy savdo solig'ini olmang.[52] Davlat poytaxti, Juneau, 5 foizli soliq stavkasiga ega.[54]

Arizona

Arizona bor bitim imtiyozlari solig'i (TPT) haqiqiy savdo soliqidan farq qiladi, chunki u a yalpi tushum solig'i, sotuvchining yalpi tushumidan olinadigan soliq va iste'molchining majburiyati emas.[55] Sotuvchilarga soliq miqdorini iste'molchiga o'tkazishga ruxsat beriladi, ammo soliq uchun davlat javobgar bo'lib qoladi.[56] TPT 16 ta soliq tasnifi bo'yicha qo'llaniladi,[57] ammo aksariyat chakana operatsiyalarga 6,6% soliq solinadi.

Shahar va tumanlar umumiy stavkaga 6 foiz qo'shishi mumkin.[58] Uyda iste'mol qilish uchun oziq-ovqat, retsept bo'yicha dorilar (shu jumladan retsept bo'yicha dorilar va ma'lum belgilangan gomeopatik vositalar ) va boshqa ko'plab moddiy shaxsiy mulk ob'ektlari davlat chakana savdo punktlaridan ozod qilinadi; shaharlar oziq-ovqat uchun soliq to'lashi mumkin va ko'pchilik to'laydi. Arizona shtatidagi TPT - bu qurilish materiallarini sotishdan ko'ra, pudrat ishlariga solinadigan mamlakatdagi kam sonli aktsiz soliqlaridan biridir.[59] Feniks, poytaxt va eng katta shahar, 2% TPT stavkasiga ega.[60]

Foydalanish solig'i shtatdan tashqari onlayn-chakana savdo do'konlari va kataloglardan qilingan xaridlarga nisbatan qo'llaniladi. 2011 yil iyul oyida qabul qilingan qonun Arizona aholisidan soliqlardan qancha foydalanganliklari to'g'risida deklaratsiya qilishni talab qiladi.[61]

Arizona shtatidagi hindlarning rezervasyonlari o'zlarining savdo soliqlariga ega va bu Qo'shma Shtatlardagi savdo soliqlarining eng yuqori stavkalari.[62] 2012 yilga kelib mamlakatda eng yuqori savdo solig'i, 13,725%, topilgan Tuba shahri.[63]

Arkanzas

Arkanzas davlat savdo solig'i 6,50% ni tashkil qiladi. Shahar soliqlari qo'shimcha 0,25% dan 3,5% gacha, tuman soliqlari esa 3,25% gacha bo'lishi mumkin.[64] Shahar va tuman soliqlarini hisobga olgan holda, sotish bo'yicha eng yuqori stavka qismlarida 11,625% ni tashkil qiladi Mensfild ular ichida Skott okrugi.[65]

2019 yil 1-yanvardan boshlab Arkanzas shtati tayyor bo'lmagan oziq-ovqat mahsulotlariga (oziq-ovqat mahsulotlariga) sotishdan olinadigan soliq 1,5% dan 0,125% gacha (1% ning 1/8 qismi) kamaytirildi. Ilgari oziq-ovqat mahsulotlarini sotish bo'yicha soliqlar 2011 yil 1 iyuldagi 2 foizdan 1,5 foizgacha, 2009 yil 1 iyuldagi 3 foizdan 2 foizgacha va 2007 yil 1 iyuldagi 6 foizdan 3 foizgacha pasaytirildi. Oziq-ovqat mahsulotlarining mahalliy soliqlari. o'zgarishsiz qoldi.

Kaliforniya

Kaliforniya, 1991 yildan 2012 yilgacha va 2017 yildan buyon 6% davlat solig'i va 1,25 foiz yagona mahalliy soliqdan iborat 7,25 foizli bazaviy savdo solig'i mavjud.[66] Kaliforniya Qo'shma Shtatlardagi o'rtacha shtat va mahalliy savdo solig'i stavkasining eng yuqori ko'rsatkichi bo'yicha o'ninchi o'nlikka ega bo'lib, 8,25% ni tashkil etadi.[66] 2019 yil iyul oyidan boshlab shahar stavkalari o'zgarib turadi - 7,25% dan 10,5% gacha (Santa Fe Springs ).[67] Sotish va foydalanish soliqlari Kaliforniya soliq va to'lovlarni boshqarish departamenti (2017 yil iyulgacha ushbu soliqlar tomonidan yig'ilgan Kaliforniya shtatining tenglashtirish kengashi ). Daromadlar va franchayzing soliqlari tomonidan alohida yig'iladi Kaliforniya Franchise soliq kengashi.

Umuman olganda, sotish solig'i o'zining yakuniy iste'molchisiga moddiy shaxsiy mol-mulkni sotib olishda talab qilinadi. Protezlar va stomatologik implantlar kabi tibbiy asboblar protezlar, stomatologik ortopediya / ortopedik vositalar va davlatning shaxsiy mulki sifatida ko'rib chiqadigan tish kronlari kabi protez tishlari bundan mustasno, sotishdan olinadigan soliqdan ozod qilinadi.[68] Oziq-ovqat mahsulotlari, non mahsulotlari, issiq ichimliklar, konfetlar, chorva mollari, ekinlar va urug'lar, oziq-ovqat mahsulotlarini etishtirish uchun ishlatiladigan o'g'itlar, muqobil energiya bilan bog'liq ba'zi qurilmalar va bir martalik sotuvlar ham savdo soliqlaridan ozod qilinadi.[69]

Kolorado

Kolorado davlat savdo solig'i 2,9% ni tashkil qiladi, ba'zi shahar va tumanlarda qo'shimcha soliqlar olinadi.[70] Denver moddiy boyliklarga solinadigan soliq 3,62% ni tashkil etadi, uydan tashqarida yeb bo'lingan ovqatlarga 4% soliq solinadi, ko'pgina tayyor bo'lmagan oziq-ovqat mahsulotlari (oziq-ovqat mahsulotlari) ozod qilinadi. 2011 yil 31 dekabrda tugagan, ammo ommaviy tranzit solig'i va ilmiy va madaniy ob'ektlar uchun soliq stavkasi mavjud bo'lgan futbol stadioniga soliq. Umumiy savdo solig'i shahar va tumanga qarab farq qiladi. Sotib olingan mahsulot bo'yicha umumiy savdo solig'i Falcon, Kolorado, 5,13% (2,9% shtat, 1,23% graflik va 1% PPRTA) bo'ladi. Larimer okrugidagi savdo soliq stavkasi taxminan 7,5%. Denver va uning atrofidagi aksariyat operatsiyalarga jami taxminan 8% soliq solinadi. Denverda nooziq-ovqat tovarlari uchun sotiladigan soliq stavkasi 7,62% ni tashkil qiladi. Oziq-ovqat va ichimliklar jami 8,00%, ijaraga olingan avtomobillar esa 11,25%.[71]

Konnektikut

Konnektikut 6,35% savdo solig'iga ega bo'lib, 2011 yil 1 iyuldagi 6 foizdan davlatga 6,25 foiz, okrugga 0 foiz va shahar / shaharga 0,1 foiz miqdorida ko'tarildi.[72] Tayyor bo'lmagan oziq-ovqat mahsulotlarining aksariyati, shuningdek retsept bo'yicha beriladigan dori-darmonlar, barcha internet xizmatlari, barcha jurnal va gazetalarga obuna va darsliklar (faqat kollej o'quvchilari uchun) ozod qilinadi.[73] Shuningdek ixcham lyuminestsent lampalar Konnektikut shtat qonuni bo'yicha soliqlardan ozod qilinadi.

Chakana sotuvchi tomonidan xaridorga etkazilgan etkazib berish va etkazib berish to'lovlari, shu jumladan AQSh pochta aloqasi uchun to'lovlar, soliq solinadigan moddiy shaxsiy mol-mulk yoki xizmatlarni sotish bilan bog'liq holda, sotish va foydalanishda soliqlarga tortiladi. Soliq, agar to'lovlar alohida ko'rsatilgan bo'lsa ham, etkazib berish yoki etkazib berish sotuvchi yoki uchinchi shaxs tomonidan taqdim etilishidan qat'iy nazar qo'llaniladi. Sotish yoki foydalanishga solinadigan soliqqa tortilmaydigan har qanday sotish bilan bog'liq holda etkazib berish va etkazib berish to'lovlari uchun soliq olinmaydi. Sotish yoki ozod qilingan narsalarni sotish uchun sotish bilan bog'liq etkazib berish yoki etkazib berish to'lovlari soliqqa tortilmaydi. Xuddi shu tarzda, pochta aloqasi yoki etkazib berish xizmatlari uchun to'lovlar, agar ular soliq to'lamaydigan xizmatlarni sotish bilan bog'liq bo'lsa, soliqqa tortilmaydi.[74]

Delaver

Delaver iste'molchilar uchun savdo solig'ini hisoblamaydi. Shtat aksariyat korxonalarning yalpi tushumiga soliq soladi va transport vositalarini ro'yxatdan o'tkazishda 4,25% hujjat to'lovi. Tadbirkorlik va kasb-hunar litsenziyalariga soliq stavkalari, tadbirkorlik faoliyati toifasiga qarab 0,096 foizdan 1,92 foizgacha.

Kolumbiya okrugi

Kolumbiya okrugi, 2013 yil 1 oktyabr holatiga savdo soliq stavkasi 5,75% ni tashkil etadi.[75] Soliq moddiy shaxsiy mol-mulkni sotish va tanlangan xizmatlarga solinadi. (Tayyorlanmagan oziq-ovqat, shu jumladan, shisha suv va uy hayvonlari uchun oziq-ovqat mahsulotlaridan savdo solig'i olinmaydi; ammo sodali suv va sport ichimliklar savdo solig'iga tortiladi.) Xonadon tashqarisida iste'mol qilinganligi sababli sotiladigan spirtli ichimliklarga 10% soliq solinadi, 10 Restoran taomlari (shu jumladan, olib yurish) va ijaraga olingan mashinalar uchun%, mashinalar uchun 18% va mehmonxonalar uchun 14,5%. Mehmonxona va restoranlarda ovqatlanish stavkasining bir qismi Konventsiya markazi fondiga ajratiladi. Oziq-ovqat mahsulotlari, retsept bo'yicha va retseptsiz beriladigan dori vositalari va uy-joy kommunal xizmatlari tuman savdo solig'idan ozod qilingan.[76]

Tumanda har yili bir marta "maktabga qaytish" paytida va Rojdestvo arafasida ikkita savdo solig'i ta'tili bo'lgan. "Maktabga qaytish" soliq ta'tili 2009 yil 12 mayda bekor qilingan.[77]

2010 yil 1 yanvardan boshlab, agar savdo do'konida oziq-ovqat yoki spirtli ichimliklar sotadigan bo'lsa, chakana savdo do'koni tomonidan taqdim etilgan har bir plastik yoki qog'oz paket uchun sumkadan 5 sentdan soliq undirila boshlandi. Chakana savdogar soliqning bir foizini yoki mijozlarga o'z sumkalarini olib kelish uchun qaytarib berishni taklif qilsa, ikki sentni ushlab qoladi. Qolgan uch-to'rt tsent tumanga tushadi Anakostiya daryosi tozalash fondi.[78]

Florida

Florida sotishdan olinadigan umumiy soliq stavkasi 6% ni tashkil qiladi. Mayami-Dade okrugi, aksariyat Florida okruglari singari, qo'shimcha savdo maoshining soliq miqdorini 1% tashkil etadi.[79] Soliq tovarlarni sotish yoki ijaraga berish, kirishni sotish, ko'chmas mulkni ijaraga berish, litsenziyalash yoki ijaraga berish, vaqtincha yashash joylarini ijaraga berish yoki ijaraga berish va tijorat zararkunandalari kabi cheklangan miqdordagi xizmatlarni sotishda olinadi. nazorat qilish, tijorat tozalash va muayyan himoya xizmatlari. Oziq-ovqat mahsulotlari va retseptlar kabi soliqlardan turli xil imtiyozlar mavjud.

Savdo solig'i va o'zboshimchalik bilan sotish solig'i har bir soliq solinadigan operatsiya bo'yicha hisoblanadi. Bitim ikki dollarga teng bo'lganida, Florida savdo solig'ini hisoblash uchun braket tizimidan foydalanadi. Butun dollar miqdorini soliq stavkasiga ko'paytiring (6 foiz va tuman soliq stavkasi stavkasi) va qavs tizimidan foydalanib, soliqni bir dollardan kam bo'lgan miqdorni aniqlang. Daromadlar bo'limida aholiga yordam berish uchun stavkalar jadvallari (DR-2X shakli) mavjud.[79]

"Ixtiyoriy ravishda sotish bo'yicha soliq to'lovi" 2,5% gacha bo'lgan tumanlar tomonidan belgilanishi mumkin, ular belgilangan tuman stavkasi bo'yicha olinadi (agar jo'natilgan bo'lsa). Bu aksariyat okruglarda 1%, ko'pchilikda 0,5% va shunga o'xshash bir qator viloyatlarda 1,5% Leon. 2019 yildan boshlab Hillsboro okrugining soliq to'lash darajasi 2,5% ga ko'tarildi. Bir nechta okruglarda qo'shimcha soliq to'lovi yo'q. Ko'pchilikning amal qilish muddati bor, ammo ba'zilari yo'q. Faqat katta miqdordagi xaridning dastlabki 5000 dollari soliq stavkasiga bog'liq.[80] Aksariyat okruglar ta'lim yoki transportni yaxshilash uchun soliq to'lashadi.

Har yili o'zgarishi mumkin bo'lgan ma'lum narx bo'yicha kiyim-kechak, poyabzal va o'quv anjomlari uchun avgust oyida maktabga soliq to'lovi ta'tilini o'tkazish kabi yillik savdo solig'i ta'tillari mavjud, shuningdek 2007 yil iyun oyida targ'ib qilish uchun bo'ronga tayyorlik. 2008 yilgi qonun chiqaruvchilar har qanday savdo solig'i ta'tilini rasmiylashtirmaganlar.

Florida, shuningdek, okruglarga har qanday mehmonxonada, turar joy mehmonxonasida, motelda, kurortda joylashgan motelda, kvartirada, kvartirada joylashgan motelda, turar joy uyida, ko'chma uy parkida, 6 oy va undan kam qolish uchun qo'shimcha ravishda 13 foizgacha "turistik rivojlanish solig'i" ni oshirishga ruxsat beradi. rekreatsion avtoulovlar parki, kondominium yoki taymshare kurorti.[81]

2010 yil may oyida, Florida, qayiq va kemalarga sotish narxini, sotib olish narxidan qat'i nazar, maksimal 18000 AQSh dollar miqdorida cheklaydigan qonun qabul qildi.[82] Bu mulk egalarini sotib olgandan keyin Shtatni tark etmaslikka yoki aksariyat egalar ushbu qonun qabul qilinishidan oldin amalga oshirgan "offshor" bayroqchasiga undaydi. Natijada, Florida daromadlari bo'limi qayiqlarni sotishdan tushadigan savdo solig'i tushumlarining keskin o'sishiga erishdi.[iqtibos kerak ]

Florida - tijorat yoki uy-joy mulkini ijaraga berish uchun savdo solig'ini to'laydigan yagona shtat bo'lib, soliqdan yiliga milliard dollardan ko'proq mablag 'yig'adi. Olti oydan ortiq bo'lgan turar-joy ijarasi soliqdan ozod qilinadi.[83]

Gruziya

Gruziya 1989 yil 1 apreldan boshlab 3 foizdan ko'tarilganidan beri davlat savdo soliqlarining 4 foiz stavkasiga ega.[84] Xizmatlar (shu jumladan pochta aloqasi lekin emas yuk tashish; yetkazib berish ) va retsept bo'yicha dorilar umuman soliq solinmaydi retseptsiz beriladigan dorilar, dorixona tibbiy asboblar va boshqa asosiy ehtiyojlar to'liq soliqqa tortiladi. 1990-yillardan boshlab, oziq-ovqat mahsulotlari (mahalliy iste'mol uchun mo'ljallanmagan qadoqlangan oziq-ovqat mahsulotlari) davlat savdo solig'idan ozod qilinadi, ammo baribir mahalliy savdo solig'i stavkasi hisobga olinadi. 2010-yillarning boshidan beri narsalar tayyorlangan oziq-ovqat do'konlarida (hatto bo'lmaganlar ham) kafelar ), masalan, yangi non dan novvoyxona, uy sharoitida iste'mol qilishning asosiy ehtiyojlari bo'lishiga qaramay, ular oziq-ovqat mahsulotlari bo'lmaganidek soliq solinadi.

Gruziya davlatlari mahalliy savdo solig'ini 1%, 2% yoki 3% miqdorida, Gruziya qonunchiligida ruxsat berilgan uchta (1 to'plamdan tashqari) uchta mahalliy optsion savdo soliqlaridan iborat bo'lishi mumkin. Bularga maxsus soliq (YO'Q ) ma'lum bir loyiha ro'yxatlari uchun, LOST umumiy maqsadli, a uy sharoitida ozod qilish (HOST) va uchun ma'rifiy davlat maktablari (ELOST) uchun taqdim etilishi mumkin referendum tomonidan maktab kengashlari (okrug va uning har qanday shahri kelishishi kerak) o'rniga okrug komissiyasi (u bilan hamkorlikda shahar kengashlari ) boshqa soliqlar kabi. Shuningdek, shahar Atlanta ruxsat bergan qo'shimcha ravishda 1% munitsipal optsion savdo solig'i (MOST) belgilaydi maxsus qonunchilik ning Gruziya Bosh assambleyasi va oxirgi marta saylovchilar tomonidan yangilangan 2016 yil fevral oyidagi prezidentlik saylovlari 2020 yilgacha. Bu[85] uni tuzatish uchun suv va kanalizatsiya tizimlar, asosan ajratish orqali bo'ronli kanalizatsiya dan sanitariya kanalizatsiya.[84] 2016 yil aprel oyida MARTA uchun qo'shimcha yarim foiz miqdorida referendum o'tkazildi, ammo shimol atrofidagi boy shaharlarning qonun chiqaruvchilari, agar ularning tumanlari chiqarib tashlanmasa, qonun loyihasini ilgari surishga ruxsat berishdan bosh tortgandan so'ng, faqat Atlanta shahri uchun qonun imzolandi. Bu asosan mablag'lardan foydalanishni cheklaydi Atlanta Beltline 2057 yilgacha shahar chegaralarida zarur bo'lgan yagona kengaytirish loyihasi bo'lib, shimoliy (qizil) chiziqning Rozvell va Alpharetta tirbandlikni engillashtirish uchun eng zarur bo'lgan joyda.

2016 yil mart oyidan boshlab,[86] Jorjiyada sotishdan tushgan umumiy soliq stavkalari 107-da oziq-ovqat mahsulotlari uchun 3% va boshqa mahsulotlar uchun 7% uning 159 okrugi. Etti tuman mahalliy soliqdan atigi 2 foizni (oziq-ovqat bo'lmagan narsalarga jami 6 foiz) to'laydi va biron bir tuman nol yoki 1 foizni undirmaydi, ammo 45 ta shahar TSPLOST tufayli 4 foiz (jami 8 foiz) to'laydi. Ba'zilar qisman (ammo to'liq emas) oziq-ovqat mahsulotlarini mahalliy soliqdan ozod qiladilar, bu esa restoranlarga tegishli bo'lmagan taomlardan boshqa mahsulotlarga nisbatan 1 foizga arzonroq. Fulton va DeKalb (va 2015 yildan beri, Kleyton ) tumanlar uchun 1% miqdorida haq olinadi MARTA va qo'shni Atlanta metrosi agar xohlasa, okruglar buni referendum orqali amalga oshirishi mumkin. Atlantada joylashgan Fulton va DeKalb qismlari uchun eng ko'pi oziq-ovqat mahsulotlarida mos ravishda 4% va 3% va boshqa buyumlar uchun 8% ni tashkil qiladi. Shaharlar va Muscee tumanlar "boshqa" soliqni o'zlarining uchta 1% soliqlaridan biri sifatida sanab chiqdilar.

2012 yildan boshlab, yangi qonun bilan belgilangan hududlarning har biri moliyalashtirish uchun TSPLOST savdo solig'i uchun ovoz berishga ruxsat berildi transport loyihalar, shu jumladan jamoat transporti va tezkor tranzit (bu faqat muhim rol o'ynaydi Atlanta metrosi va konstitutsiyaviy ravishda davlatdan foydalanishga to'sqinlik qildi yonilg'i solig'i daromadlar). Uch mintaqadan tashqari, aksariyat mintaqalar unga qarshi ovoz berishdi o'rta Gruziya dan Kolumb ga Augusta. TSPLOST mahalliy soliqlarning 3 foizli chegarasiga bo'ysunmaydi, shu sababli ushbu davlatlarda mahalliy stavka 8 foizgacha etadi. 2015 yilda vaziyat muqobil transport Shtatdagi huquqlar yanada yomonlashdigalon aktsiz solig'i oshirildi va benzinga sotish solig'i bekor qilindi, bundan ham ko'proq davlat mablag'lari ishlatilishiga to'sqinlik qildi tirbandlik kabi investitsiyalarni kamaytirish qatnovchi temir yo'l va boshqalar.

Florida va boshqa ba'zi shtatlarga o'xshab, Jorjiyada ilgari ikkitasi bo'lgan savdo-soliq ta'tillari yiliga, 2002 yildan boshlab. Bittasi maktabga qaytish avgust oyining birinchi dam olish kunlari, lekin ba'zida iyul oyining oxirida boshlanadi. Ikkinchidan, odatda oktyabr oyida sodir bo'lgan energiya tejaydigan maishiy texnika bilan Energy Star sertifikatlash. 2010 va 2011 yillarda savdo solig'i bo'yicha ta'til bo'lmagan, ammo ular 2012 yilning eng yomon kunlaridan keyin tiklangan 2000-yillarning oxiri tanazzul o'tgan edi.[87]

2013 yildan boshlab Gruziya endi bir martalik majburiyatni yuklaydi sarlavha shtat ichida sotiladigan barcha transport vositalariga ad valorem soliq (TAVT) (ikkalasi ham) diler va xususiy sotuvlar ushbu soliqqa kiritilgan). TAVT avtomobilning adolatli bozor qiymatiga asoslanadi. Biroq, Gruziya endi motorli transport vositalaridan sotish uchun soliq undirmaydi va TAVT soliqqa tortish tizimiga tushadigan xaridlar endi transport vositalariga yillik ad valorem soliqlarini to'lamaydi. Aslida, yangi TAVT transport vositalariga yillik avtoulov ad valorem solig'i va sotish soliqlarini birlashtirdi. Motorsiz avtoulovlar TAVT tizimiga mos kelmaydi va shuning uchun har yili ad valorem solig'i olinadi. Shtat tashqarisidan olib kelingan transport vositalari ham TAVTga bo'ysunadi. Boshqa davlatlarga to'lanadigan transport vositalarini sotish yoki ulardan foydalanish soliqlari Gruziyada TAVT hisobiga olinmaydi.

Gruziyada muayyan korxonalar va sanoat tarmoqlari uchun ko'plab imtiyozlar mavjud va xayriya tashkilotlari va boshqalar notijorat tashkilotlar kabi cherkovlar ozod qilinadi. Imkoniyatli imtiyozlarni aniqlash uchun korxonalar va iste'molchilar sotish to'g'risidagi qonunlar va qoidalarni o'rganishlari va soliqdan foydalanishlari va amaldagi ozod qilish shakllarini ko'rib chiqishlari kerak.[88]

Guam

Guam iste'molchilarga kirish, foydalanish va mehmonxonalarni to'ldirish soliqlaridan tashqari, umumiy savdo solig'i yo'q; ammo, korxonalar oylik yalpi daromadidan 5% soliq to'lashlari shart. Shahar, tuman, maktab okrugi yoki obodonlashtirish bo'yicha alohida soliqlar mavjud emas.[89]

Guamga olib kiriladigan ozod qilinmagan shaxsiy mol-mulk uchun soliqdan 5% foydalaniladi. Mehmonxonalardan olinadigan soliq kunlik xona stavkasining 11 foizini tashkil qiladi. Spirtli ichimliklar solig'i ichimlikka qarab o'zgaradi. Bundan tashqari, tamaki soliqlari, ko'chmas mulk solig'i, o'yin-kulgi soliqlari, ko'ngilochar muassasalar uchun soliqlar va suyuq yoqilg'iga solinadigan soliqlar mavjud.[90]

Ushbu biznes imtiyozlari solig'i stavkasi 2018 yil 1-iyundan boshlab 4% dan 5% gacha ko'tarildi. Dastlab, 2018 yil 1-oktabrda Guam 2% sotish va foydalanishga solinadigan soliqni joriy etishni kutganida, yana 4% ga o'zgarishi kutilgan edi. Ushbu qonun loyihasi bekor qilindi va 5 foizli stavka amalda qoldirilib, biznes uchun imtiyozli soliq stavkasining amal qilish muddati tugadi.

Gavayi

Gavayi savdo solig'i yo'q o'z-o'zidan, lekin u a yalpi tushum solig'i (Umumiy aktsiz solig'i deb ataladi) va deyarli har qanday taxmin qilinadigan turdagi soliqlarga tegishli bitim (shu jumladan xizmatlar ) va texnik jihatdan zaryadlangan biznes o'rniga iste'molchi. Hawaii law allows businesses to pass on the tax to the consumer in similar fashion to a sales tax.

Unlike other states, rent, medical services and perishable foods are subject to the excise tax. Also, unlike other states, businesses are not required to show the tax separately on the receipt, as it is technically part of the selling price. Most retail businesses in Hawaii, however, do list the tax as a separate line item. 4.0% is charged at chakana savdo with an additional 0.5% surcharge in the Honolulu shahri va okrugi (for a total of 4.5% on Oahu sales), and 0.5% is charged on ulgurji savdo.[91] However, the state also allows "tax on tax" to be charged, which effectively means a customer can be billed as much as 4.166% (4.712% on Oaxu ). The exact dollar or percentage amount to be added must be quoted to customers within or along with the price. The 0.5% surcharge on Oahu was implemented to fund the new rail transport system. As with sales tax in other states, nonprofit organizations may apply for an exemption from the tax.[92]

Hawaii also imposes a "use tax" on businesses that provide services that are "LANDED" In Hawaii. One example is: A property owner in Hawaii contracts with a mainland architect to design their Hawaii home. Even though the architect perhaps does all of their work in a mainland location, the architect needs to pay the State of Hawaii a 4% use tax on the architect's fee because the designed house is located in Hawaii (even if the house is never built). The tax is on the produced product which is the design and provided building plans. This applies to commercial property designs as well.

Aydaho

Aydaho initiated a sales tax of 3.0% in 1965 and the current rate is 6.0%. Some localities levy an additional local sales tax.[93]

Illinoys

Illinoys ' sales and use tax scheme includes four major divisions: Retailers' Occupation Tax, Use Tax, Service Occupation Tax and the Service Use Tax.[94] Each of these taxes is administered by the Illinois Department of Revenue. The Retailers' Occupation Tax is imposed upon persons engaged in the business of selling tangible personal property to purchasers for use or consumption. It is measured by the gross receipts of the retailer. The base rate of 6.25% is broken down as follows: 5% State, 1% City, 0.25% County. Local governments may impose additional tax resulting in a combined rate that ranges from the State minimum of 6.25% to 9.00% as of May 2013.[95][96]

Springfield charges 8.00% total (including state tax). A complementary Use Tax is imposed upon the privilege of using or consuming property purchased anywhere at retail from a retailer. Illinois registered retailers are authorized to collect the Use Tax from their customers and use it to offset their obligations under the Retailers' Occupation Tax Act. Since the Use Tax rate is equivalent to the corresponding Retailers' Occupation Tax rate, the amount collected by the retailer matches the amount the retailer must submit to the Illinois Department of Revenue. The combination of these two taxes is what is commonly referred to as "sales tax". If the purchaser does not pay the Use Tax directly to a retailer (for instance, on an item purchased from an Internet seller), they must remit it directly to the Illinois Department of Revenue.[97]

The Service Occupation Tax is imposed upon the privilege of engaging in service businesses and is measured by the selling price of tangible personal property transferred as an incident to providing a service. The Service Use Tax is imposed upon the privilege of using or consuming tangible personal property transferred as an incident to the provision of a service. An example would be a printer of business cards. The printer owes Service Occupation Tax on the value of the paper and ink transferred to the customer in the form of printed business cards. The serviceperson may satisfy this tax by paying Use Tax to his supplier of paper and ink or, alternatively, may charge Service Use Tax to the purchaser of the business cards and remit the amount collected as Service Occupation Tax on the serviceperson's tax return. The service itself, however, is not subject to tax.

Qualifying food, drugs, medicines and medical appliances[98] have sales tax of 1% plus local home rule tax depending on the location where purchased. Newspapers and magazines are exempt from sales tax as are legal tender, currency, medallions, bullion or gold or silver coinage issued by the State of Illinois, the government of the United States of America, or the government of any foreign country.

Shahar Chikago has one of the highest total sales tax of all major U.S. cities (10.25%).[99] It was previously this high (10.25%), however, it was reduced when Cook County lowered its sales tax by 0.5% in July 2010, another 0.25% in January 2012, and another 0.25% in January 2013.[100] Chicago charges a 2.25% food tax on regular groceries and drug purchases, and has an additional 3% soft drink tax (totaling 13.25%). An additional 1% is charged for prepared food and beverage purchases in the Loop and nearby neighborhoods (the area roughly bordered by Diversey Parkway, Ashland Avenue, the Stevenson Expressway, and Lake Michigan).

Illinois requires residents who make purchases online or when traveling out-of-state to report those purchases on their state income tax form and pay use tax. In 2014, Illinois passed legislation which required sales tax to be collected by "catalog, mail-order and similar retailers along with online sellers... if they have sales of $10,000 or more in the prior year." Although the law went into effect January 1, 2015, retailers were given an additional month to comply with the legislation.[101]

Indiana

Indiana has a 7% state sales tax. The tax rate was raised from 6% on April 1, 2008, to offset the loss of revenue from the statewide property tax reform, which is expected to significantly lower property taxes. Previous to this it was 5 percent from 1983 to 2002. It was 6 percent from 2002 to 2008. The rate currently stands at 7 percent. Untaxed retail items include medications, water, ice and unprepared, raw staple foods or fruit juices. Many localities, inclusive of either counties or cities, in the state of Indiana also have a sales tax on restaurant food and beverages consumed in the restaurant or purchased to go.

Revenues are usually used for economic development and tourism projects. This additional tax rate may be 1% or 2% or other amounts depending on the county in which the business is located. Masalan, ichida Marion okrugi, the sales tax for restaurants is 9%. There is an additional 2% tax on restaurant sales in Marion County to pay for Lukas Neft stadioni va kengayishi Indiana Kongress markazi.

Ayova

Ayova has a 6% state sales tax and an optional local sales tax of 1% imposed by most cities and unincorporated portions of most counties, bringing the total up to a maximum of 7%. There is no tax on most unprepared food. The Iowa Department of Revenue provides information about local option sales taxes,[102] including sales tax rate lookup. Iowa also has sales tax on services when rendered, furnished, or performed.[103]

Kanzas

Kanzas has a 6.5% statewide sales tax rate that began on July 1, 2015. More than 900 jurisdictions within the state (cities, counties, and special districts) may impose additional taxes. For example, in the capital city of Topeka, retailers must collect 6.5% for the state, 1.15% for Shoni okrugi, and 1.5% for the city, for a total rate of 9.15%.

As of January 2021, the highest combined rate of sales tax is 11.600%, at a Holiday Inn Express yilda Ottava.[104] Additionally, if a consumer in Kansas does not pay any sales tax at time of purchase, they must declare the unpaid tax on their yearly income tax.[105]

Kentukki

Kentukki has a 6% state sales tax. Most staple grocery foods are exempt. Alcohol sales were previously exempt until April 1, 2009, when a 6% rate was applied to this category as well.

Luiziana

Luiziana has a 4.45% state sales tax as of 1 July 2018.[106] The state sales tax is not charged on unprepared food. There are also taxes on the cherkov (county) level and some on the city levels, Baton-Ruj has a 5% sales tax.[107] Parishes may add local taxes up to 5%, while local jurisdictions within parishes may add more. In Allen Parish, the combined sales tax is up to 9.45% (0.7% for Parish Council, 3% for School Board, 1% to 1.3% for City/Town).[108] Yangi Orlean (coterminous with Orleans Parish) collects the maximum 5% tax rate for a total of 9.45% on general purpose items.[109] For food and drugs the tax rate is 4.5%, for a total of 8.95%. Louisiana bids out sales tax audits to private companies, with many being paid on a percentage collected basis.

Meyn

Meyn has a 5.5% general, service provider and use tax (raised, temporarily until further notice,[110] from 5% on October 1, 2013).[111] The tax on lodging and prepared food is 8% and short term auto rental is 10%. These are all officially known as "sales tax".

Merilend

Merilend has a 6% state sales and use tax (raised from 5% in 2007) as of January 3, 2008, with exceptions for medicine,[112] residential energy, and most non-prepared foods (with the major exceptions of alcoholic beverages, candy, soda, single-serving ice cream packages, ice, bottled water [including both still and carbonated water], and sports drinks).[113] While most goods are taxed, many services (e.g., repair,[114] haircuts, accounting) are not. Maryland's sales tax includes Internet purchases and other mail items such as magazine subscriptions.[iqtibos kerak ] Maryland has a "back-to-school" tax holiday on a limited number of consumer items.[iqtibos kerak ] On July 1, 2011, the selective sales tax on alcohol was raised from 6% to 9%.[iqtibos kerak ]

On January 1, 2012, Montgomeri okrugi began levying a 5-cent-per-bag tax on plastic and paper bags provided by retailers at the point of sale, pickup, or delivery (with few exceptions, most notably bags for loose produce in grocery stores, bags for prescription drugs, and paper bags at fast-food restaurants). Four cents of this tax goes to the county's water quality fund, and one cent is returned to the retailer.[115]

Massachusets shtati

Massachusets shtati has a 6.25% state sales tax on most goods (raised from 5% in 2009). There is no sales tax on food items, but prepared meals purchased in a restaurant are subject to a meal tax of 6.25% (in some towns voters chose to add a local 0.75% tax, raising the meal tax to 7%, with that incremental revenue coming back to the town). Sales tax on liquor was repealed in a 2010 referendum vote.Sales of individual items of clothing costing $175 or less are generally exempt; on individual items costing more than $175, sales tax is due only on the amount over $175.[116] There have been attempts by initiative petition referendum voting in Massachusetts state elections to alter the level of sales taxation overall within Massachusetts, or on certain classes of sold items: examples include the aforementioned end of taxation on alcoholic beverages that was up for voting in the 2010 state general election, and the separate overall reduction to a 3% sales tax on most in-state sales o'sha yili.

Michigan

Michigan has a 6% sales tax. Michigan has a use tax of 6%, which is applied to items bought outside Michigan and brought in, to the extent that sales taxes were not paid in the state of purchase. Residents are supposed to declare and pay this tax when filing the annual income tax.[117] Groceries, periodicals,[118] and prescription drugs are not taxed, but restaurant meals and other "prepared food" is taxed at the full rate. The tax applies to the total amount of online orders, including shipping charges.

Local government cannot impose a sales tax.

Michigan raised the sales tax rate to 6% from 4% in 1994. Michigan Ballot Proposal 2015-1, which was opposed by 80% of voters, would have raised the sales and use taxes to 7%. In 2007, Michigan passed a law extending the sales tax to services, but repealed it the day it was to go into effect.

Minnesota

Minnesota currently has a 6.875% statewide sales tax. The statewide portion consists of two parts: a 6.5% sales tax with receipts going to the state General Fund, and a 0.375% tax going to arts and environmental projects. The 0.375% tax was passed by a statewide referendum on Nov. 4, 2008, and went into effect on July 1, 2009.[119] Generally, food (not including prepared food, some beverages such as pop, and other items such as candy), prescription drugs & clothing are exempt from the sales tax.[120]

Local units of government may, with legislative approval, impose additional general sales taxes. As of July 1, 2008, an additional 0.25% Transit Improvement tax was phased in across five counties in the Minneapolis-St. Pol metropolitan area for transit development. These counties are Hennepin, Ramsey, Anoka, Dakota va Vashington. A 0.15% sales tax is imposed in Hennepin County to finance the Minnesota egizaklari yangi Maqsadli maydon. Several cities impose their own citywide sales tax: Minneapolis, Aziz Pol, Rochester (all 0.5%), and Dulut (1%). These additional taxes increase the total general sales tax rates to 7.875% in Duluth, 7.775% in Minneapolis, 7.625% in Saint Paul, and 7.375% in Rochester.

Mankato has a 0.5% sales tax since 1991. Motorized vehicles are exempt from this tax.[121] Effective April 1, 2016 Moviy Yer okrugi began imposing a 0.5% sales tax for transportation needs throughout the county.[122]

Starting on October 1, 2019, the following cities will be imposing a city sales tax: Elk daryosi 0.5%, Excelsior 0.5%, Rojers 0.25%. Starting on January 1, 2020 West Saint Paul will impose a 0.5% sales tax.[123]

In addition to general sales taxes, local units of government can, again with legislative approval, impose sales taxes on certain items. Current local option taxes include a "lodging" tax in Duluth (3%), Minneapolis (3%), and Rochester (4%), as well as served "food and beverage" tax in Duluth (2.25%).

Alcohol is taxed at an additional 2.5% gross receipts tax rate above the statewide 6.875% sales tax rate, for a total rate of 9.375%, not including any applicable local taxes. This totals 10.375% in Duluth, 10.275% in Minneapolis, 10.125% in Saint Paul, and 9.875% in Rochester.

Missisipi

Missisipi has a 7% state sales tax. Cities and towns may implement an additional tourism tax on restaurant and hotel sales. Shahar Tupelo has a 0.25% tax in addition to other taxes. Restaurant and fast food tax is 9%, like the city of Xattiesburg, masalan.

Missuri

Missuri imposes a sales tax upon all sales of tangible personal property, as well as some "taxable services";[124] it also charges a use tax for the "privilege of storing, using or consuming within this state any article of tangible personal property."[125] The state rate, including conservation and other taxes, is 4.225%, and counties, municipalities, and other political subdivisions charge their own taxes.[126] Those additional local taxes combined with "community improvement district," "transportation development district," and "museum district" taxes can result in merchandise sales taxes in excess of 10%.[127] The state sales tax rate on certain foods is 1.225%.[128]

Missouri provides several exemptions from sales tax, such as purchases by charitable organizations or some common carriers (as opposed to "contract carriers").[129] Missouri also excludes some purchases from taxation on the grounds that such sales are not sales at retail; these include sales to political subdivisions.[130] The Missuri shtati Oliy sudi in August, 2009, ruled that when a sale is excluded from taxation – as opposed to exempt from taxation – the seller must self-accrue sales tax on its purchase of the goods and remit the tax on such purchases it made.[131] This decision was reversed by two similar – but not identical – statutes added during the 2010 general assembly's regular session.

Although the purchaser is obligated to pay the tax, the seller is obligated to remit the tax, and when the seller fails to remit, the obligation to pay falls on them. As compensation for collecting and remitting taxes, and as an incentive to timely remit taxes, sellers may keep two percent of all taxes collected each period.[132] There are two exceptions to the general rule that the seller must pay the sales tax when he or she fails to collect it.

First, no sales tax is due upon the purchase of a motor vehicle that must be titled. Instead, the purchaser pays the tax directly to the Department of Revenue within one month of purchase. As long as the vehicle is taken out of state within that first month of purchase and titled elsewhere, no tax is due in Missouri. Second, if the purchaser presents an exemption certificate to the buyer at the time of sale, then the purchaser may be assessed taxes on the purchases if the certificate was issued in bad faith.

Montana

Montana does not have a state sales tax but some municipalities which are big tourist destinations, such as Oq baliq, Red Lodge, Katta osmon va G'arbiy Yellouston, have a sales tax (up to 3%). Hotels, campgrounds and similar lodging charge a "lodging and usage tax", usually at the rate of 7%. Rental car companies charge a 4% tax on the base rental rate.

Nebraska

Nebraska has a 5.5% state sales tax from which groceries are exempt. Municipalities have the option of imposing an additional sales tax of up to 1.5%, resulting in a maximum rate of 7.0%. Specific tax rates per counties are available on the web.[133] Omaha also has a 2.5% tax on prepared food and drink.[134]

Nevada

Nevada 's state sales tax rate is 6.85%. Counties may impose additional rates via voter approval or through approval of the legislature; therefore, the applicable sales tax will vary by county from 6.85% to 8.265% in Vasho okrugi. Clark County, which includes Las-Vegas, imposes 5 separate county option taxes in addition to the statewide rate – 0.5% for mass transit, 0.25% each for flood control and to fund the Southern Nevada Water Authority, 0.3% for the addition of police officers in that county and 0.1% for Allegiant stadioni, new home of Las-Vegas reyderlari. Yilda Vasho okrugi (o'z ichiga oladi Reno ), the sales tax rate is 8.265%, due to county option rates for flood control, the ReTRAC train trench project, mass transit, and an additional county rate approved under the Local Government Tax Act of 1991.[135]

For travelers to Las Vegas, note that the lodging tax rate in unincorporated Clark County, which includes the Las-Vegas Strip, is 12%. Within the boundaries of the cities of Las Vegas and Xenderson, the lodging tax rate is 13%.

Nyu-Xempshir

No statewide sales tax exists in New Hampshire. However, a 1.5% transfer tax is levied on real estate sales. Taxable meals exclude food and beverages for consumption off premises, but catered and restaurant meals are taxable at the 9% rate.

New Hampshire also imposes excise taxes on gasoline at $0.196 per gallon, cigarettes at $1.78 per pack, and beer at $0.30 per gallon.[136] A tax on the consumption of electricity, at $0.00055 per kilowatt-hour, was repealed starting in 2019.[137]

Nyu-Jersi

Holati Nyu-Jersi 's sales and use tax rate is 6.625% effective January 1, 2018.[138] Certain items are exempt from tax, notably most clothing, footwear, and food. However, there are exceptions to this statewide rate. Yilda Urban Enterprise Zones, UEZ-impacted business districts, and Salem okrugi, sales tax is collected at 50% of the regular rate (currently 3.3125%) on certain items. In addition, local sales taxes are imposed on sales of certain items sold in Atlantika Siti va qismlari Keyp May okrugi.[139] The highest sales tax in the state is in Atlantic City at 12.625% (although certain items are exempt from the additional tax).[140]

A full list of Urban Enterprise Zones is available on the State of New Jersey web site.[141]

New Jersey does not charge sales tax on unprepared food (except certain sweets and pet food), household paper products, medicine, and clothing. New Jersey does not charge sales tax on goods purchased for resale or on capital improvements but does charge sales tax on certain services.[142]

New Jersey does not charge sales tax on petrol, however, that is subject to a $0.375/gallon aktsiz solig'i. Cigarettes are subject to a $2.70/pack excise tax, in addition to sales tax.

Nyu-Meksiko

Nyu-Meksiko imposes a gross receipts tax of 5% on most retail sales or leasing of property or performance of services in New Mexico. The tax is imposed on the seller but it is common for the seller to pass the tax on to the purchaser. The state rate is 5.125%. Municipalities may assess an additional gross receipts tax, resulting in rates between 5.375% and 8.8625%.[143] Numerous specific exemptions and deductions apply. The tax may possibly increase depending on the state growth.[144]

Nyu York

The state sales tax rate in Nyu York 4% ni tashkil qiladi. All counties, by default, are authorized to collect an additional 3% sales tax on top of the state's 4% levy; under the state's uy qoidasi laws, counties and other local municipalities may only levy a higher sales tax (or a lower one, but this option is not exercised) if it is approved by the Nyu-York shtati qonunchilik palatasi, and this approval must be repeated every two years. As of 2017, all but Warren, Washington and Westchester counties in New York charge a higher sales tax rate than the 3% default rate. The combined sales tax in Utica, for example, is 8.75%. Yilda Nyu-York shahri, total sales tax is 8.875%, which includes 0.375% charged in the Metropolitan Commuter Transportation District (MCTD).

On September 1, 2007, New York State eliminated the 4% state sales tax on all clothing and footwear if the single item is priced under $110. Most counties and cities have not eliminated their local sales taxes on clothing and footwear. There are however, 5 cities (most notably New York City) and 9 counties (not including the five counties which make up New York City: Nyu York, Malika, Shohlar, Richmond va Bronks counties) that have done so.

Counties which have eliminated their local sales tax on clothing and footwear if the single item is priced under $110 are: Chautauqua, Chenango (outside the city of Norvich ), Kolumbiya, Delaver, Yashil, Xemilton, Medison (outside the city of Oneida ), Tioga va Ueyn. The Cities of Bingemton, Gloversvill, Nyu-York shahri, Olean va Sherrill do not collect a local sales tax. New York State also exempts college textbooks from sales tax.

Since June 1, 2008, when products are purchased online and shipped into New York State, some retailers must charge the tax amount appropriate to the locality where the goods are shipped, and in addition, must also charge the appropriate tax on the cost of shipping and handling. The measure states that any online retailer that generates more than $10,000 in sales via in-state sales affiliates must collect New York sales tax. The cumulative gross receipts from sales to New York customers as a result of referrals by all of the seller's resident representatives total more than $10,000 during the preceding four quarterly sales tax periods.

From October 1, 2010, to March 31, 2011, statewide sales and use tax exemption for clothing and footwear sold for less than $110 was eliminated. For New York City, this meant articles of clothing costing less than $110 were charged 4.375% tax.[145] A state sales tax exemption for clothing and footwear under $55 was reinstated from April 1, 2011, through March 31, 2012. The original ($110) exemption was reinstated after March 31, 2012.[146]

Shimoliy Karolina

Shimoliy Karolina has a state-levied sales tax of 4.75%, effective July 1, 2011, with most counties adding a 2% tax, for a total tax of 6.75% in 72 of the 100 counties. Meklenburg va Uyg'oning counties levy an additional 0.5% tax, which is directed towards funding the engil temir yo'l tizimi, for a total of 7.25% and the total sales tax in 25 other counties is 7%. Durham okrugi va Oranj okrugi impose an additional 0.5% tax onto the 7% rate for funding public transportation, making the total rate 7.5%.[147] The Wake County Board of Commissioners levied a Prepared Food and Beverage Tax of 1% of the sale price of prepared food and beverages effective January 1, 1993, bringing the total to 7.75%.[148]

There is a 34.0¢ tax per gallon on gaz, a 45¢ tax per pack of cigarettes, a 79¢ tax per gallon on wine, and a 53¢ tax per gallon on beer. Most non-prepared food purchases are taxed at a uniform county tax rate of 2%. Alcohol and certain other goods are taxed at a "combined rate" of 7%, which includes both state tax and a 2.25% county tax. Candy, soft drinks, and prepared foods are taxed at the full combined 6.75-7.5% rate, with some counties levying an additional 1% tax on prepared foods. A sales tax holiday on the first Friday in August through the following Sunday, which included school supplies, school instructional materials, clothing, footwear, sports and recreation equipment, and computers and computer accessories, was repealed in 2014 after being in force since 2002.

Shimoliy Dakota

Shimoliy Dakota has a 5% state sales tax for general sales, but varies depending on the category (5%, 7%, 3% and 2%).[149] Local taxes increase the total rates to 7.5% in Fargo, Vodiy shahri va Pembina; 7.25% in Grafton; 7.5% in Minot; 6.75% in Grand Forks; 6.5% in G'arbiy Fargo, Dikkinson va Uilliston; and 6.0% in Bismark va Mandan.

Ogayo shtati

Ogayo shtati has a 5.75% state sales tax.[43] Counties may levy a permissive sales tax of 0.25% up to 1.5% and transit authorities, mass transit districts usually centered on one primary county, may levy a sales tax of 0.25% up to 1.5%. Kuyaxo okrugi has the highest statewide sales tax rate (8%). Tax increments may not be less than 0.25%, and the total tax rate, including the state rate, may not exceed 8.75%. County permissive taxes may be levied by emergency resolution of the county boards of commissioners. Transit authority taxes must and county permissive taxes may be levied by a vote of the electors of the district or county.

Shipping and handling charges are also taxable. Ohio law requires virtually every type of business to obtain an Ohio Sales Tax Certificate Number. If someone sells goods on eBay or the internet and ships them to someone in the state they reside, then they must collect sales tax from the buyer and pay the collected tax to the state on a monthly or quarterly basis. If someone sells less than $4 million in annual sales, they do not have to collect or pay sales tax on out-of-state sales.

Ohio Sales Tax Resale Certificate Example: If living in Ohio and selling or shipping something to someone else in Ohio, then one must collect and pay sales tax to the State of Ohio. But if selling the same item to someone outside the State of Ohio, one need not charge sales tax, but must report the exempt tax sale to the State of Ohio. Ohio also has a gross receipts tax called the Commercial Activity Tax (CAT) that is applicable only to businesses but shares some similarities to a sales tax. "Food for human consumption off the premises where sold" is exempt from sales tax, with the exception of sodas and alcoholic beverages which are taxed at the full rate.[150][151]

Oklaxoma

Oklaxoma has a 4.5% sales tax rate. Counties and cities each have an additional sales tax which varies, but is generally up to 2% for counties and 2-5% for cities resulting in a total sales tax rate of 7.5% to 8.5%.[152]

Oregon

Oregon has no statewide sales tax, although local municipalities may impose sales taxes, such as the 5% prepared food tax in Ashland.[153]

Oregon does collect some business and excise taxes[154] that may be passed along to (or must be collected from) consumers in some form or another. These include a 1% state lodging tax,[155] various tobacco taxes,[156] telecommunications taxes,[157] and ″privilege tax″ (excise tax) on beer, wine, spirits and new vehicles.[158][159] Many localities also collect additional lodging taxes.[160][161]

Pensilvaniya

Pensilvaniya has a 6% sales tax rate. Allegeni okrugi has local sales tax of 1% on top of the PA sales tax rate that totals 7%. Filadelfiya okrugi has a local sales tax of 2% on top of the PA sales tax rate that totals 8%, which became effective October 8, 2009.

Food, most clothing, and footwear are among the items most frequently exempted.[162] However, taxed food items include alkogolsiz ichimliklar and powdered mixes, sport ichimliklar, hot beverages, hot prepared foods, sendvichlar va salad bar meals, unless these items are purchased with oziq-ovqat markalari. Additionally, catering and delivery fees are taxed if the food itself is taxed.

Additional exemptions include internet service,[163] gazetalar, darsliklar, disposable diapers, ayollar gigienasi mahsulotlar, toilet paper, nam salfetkalar, retsept bo'yicha dorilar, ko'p retseptsiz beriladigan dorilar and supplies, og'iz gigienasi items (including toothbrushes va tish pastasi ), Kontakt linzalari va ko'zoynak, sog'liqni saqlash klubi va tanning booth fees, burial items (like tobutlar, urna va toshlar ), shaxsiy himoya vositalari for production personnel, work forma, veterinariya services, pet medications, yoqilg'i for residential use (including ko'mir, o'tin, mazut, tabiiy gaz, wood pellets, bug ' va elektr energiyasi ), many dehqonchilik supplies and equipment, muz,[164] and tea[165] (including powdered, hot, cold, and flavored).

The taxability of alcoholic beverages is slightly complicated. In Pennsylvania, alcohol is sold to businesses and consumers through the Pensilvaniya likyor-ichimliklarni nazorat qilish kengashi (PLCB). The PLCB always charges sales tax directly to the purchasing entity. Therefore, if a consumer purchases alcohol in PLCB stores, the sales tax is assessed at the point of purchase, but if a consumer purchases alcohol at a licensed business (such as a bar or restaurant), the sales tax is not applied because it had already been paid when the business purchased the alcohol from the PLCB. The PLCB charges an additional 18% levy on liquor and wine, but this tax is always included in the price regardless of the purchasing location. Beer is subject to an excise of $0.08 per gallon.

Puerto-Riko

Puerto-Riko has a 10.5% commonwealth sales tax that applies to both products and services with few exemptions (including items such as unprocessed foods, prescription medicines and business-to-business services). Additionally, most municipalities have a city sales tax of 1% for a total of 11.5%. Some items that are exempt from commonwealth sales tax, specifically unprocessed foods, are subject to the city sales tax in the municipalities.[166][167]

Rod-Aylend

Rod-Aylend has a state sales tax of 7%. The rate was raised from 5% to 6% as a temporary measure in the 1970s, but has not since been lowered. Rhode Island raised its sales tax from 6% to 7% in the early 1990s to pay for the bailout of the state's failed credit unions. The change was initially proposed as a temporary measure, but was later made permanent. Other taxes may also apply, such as the state's 1% restaurant tax. Many items are exempt from the state sales tax, e.g., food (excluding single serve items), prescription drugs, clothing and footwear (except for individual items priced greater than $250[168]), newspapers, coffins, and original artwork.

Janubiy Karolina

Janubiy Karolina has a 6% state sales tax but when combined with local, county and hospitality taxes South Carolina has a maximum sales tax of 10.5%.

Yilda Charlston, the tax rate equals 10.5% with state tax, county tax, local option tax, and the hospitality tax. Shahar Mirtl-Bich states that mixed liquor drinks can have taxes added as high as 16.5%.[169]

As of June 1, 2007 counties and some cities may impose an additional 1% to 3% sales tax. As of mid-2005, 35 of 46 counties do so. Restaurants may also charge an extra 1-2% tax on prepared food (fast food or take-out) in some places. The state's sales tax on unprepared food disappeared completely November 1, 2007. There is a cap of $300 on sales tax for most vehicles.

Additionally, signs posted in many places of business inform that South Carolina residents over the age of 85 are entitled to a 1% reduction in sales tax.

For the benefit of back-to-school shoppers, there is a sales tax holiday on the first Friday in August through the following Sunday which includes school supplies, school instructional materials, clothing, footwear, sports and recreation equipment, and computers and computer accessories.

Janubiy Dakota

Janubiy Dakota has a 4.5% state sales tax, plus any additional local taxes. An additional 1.5% sales tax is added during the summer on sales in tourism-related businesses, dedicated to the state's office of tourism.

City governments are allowed a maximum of 2% sales tax for use by the local government, especially in Syu sharsharasi yilda Minnehaha County. However, they can impose a gross receipts tax on things like lodging, alcohol, restaurants, and admissions. These gross receipts are passed on by the business and could be considered a sales tax.

Tribal governments are allowed to charge a higher local government tax rate, by special agreement with the state.

Tennessi

Tennessi charges 7% sales tax on most items, but 4% on groceries.[170]

Counties also tax up to 2.75% in increments of 0.25%. In most places, the county rate is about 2.25%, making the total tax on sales about 9.25%. If a county does not charge the maximum, its cities can charge and keep all or part of the remainder. Several cities are in more than one county, but none of these charges a city tax.[171][172]

The uniform state tax rate used to be 6%. Effective 1 July 2002, the tax rate was raised to 7% except for groceries. The rate for groceries was lowered to 5.5% effective 1 January 2008, to 5% on 1 July 2013, and to 4% on 1 July 2017.

Texas

The Texas state sales and use tax rate is 6.25% since 1990, but local taxing jurisdictions (cities, counties, special purpose districts, and transit authorities, but specifically not including school districts) may also impose sales and use taxes up to 2% for a total of 8.25%.[173] Prepared food, such as restaurant food, is subject to the tax, but items such as medicines (prescription and over-the-counter), food, and food seeds, are not.[173][174]

Motor vehicle and boat sales are taxed at only the 6.25% state rate; there is no local sales and use tax on these items. In addition, a motor vehicle or boat purchased outside the state is assessed a use tax at the same rate as one purchased inside the state. The sales tax is calculated on the greater of either the actual purchase price or the "standard presumptive value" of the vehicle, as determined by the state, except for certain purchases (mainly purchases from licensed dealers or from auctions).[175]

Lodging rates are subject to a 6% rate at the state level, with local entities being allowed to charge additional amounts. For example, the city of Austin levies a 9% hotel/motel tax, bringing the total to 15%, trailing only Houston for the highest total lodging tax statewide, at 17%.[176] Lodging for travelers on official government business is specifically exempt from tax but the traveler must submit an exemption form to the hotel/motel and provide proof of official status.[177]

If merchants file and pay their sales and use tax on time, they may subtract half of one percent of the tax collected[noaniq ] as a discount, to encourage prompt payment and to compensate the merchant for collecting the tax from consumers for the state.[178]

Texas provides one sales tax holiday per year (generally in August prior to the start of the school year, running from Friday to Sunday of the designated weekend). Clothing less than $100 (except for certain items, such as golf shoes) and school supplies are exempt from all sales tax (state and local) on this one weekend only. There has also been talk of a tax free weekend in December to help with the Holiday shopping season.

Yuta

Yuta has a base rate of sales tax of 5.95%, consisting of a state sales tax of 4.70% and uniform local taxes totaling 1.25%. Additionally, local taxing authorities can impose their own sales tax. Currently, the majority of Utah's aggregate sales taxes are in the range of 5.95 – 8.35%. Utah has a 16.350% sales tax on rental cars in Salt Lake City.[179]The sales tax on food and food ingredients is 3.0% statewide. This includes the state rate of 1.75%, local option rate of 1.0% and county option rate of 0.25%.

Vermont