2003 yildan boshlab jahon neft bozorining xronologiyasi - World oil market chronology from 2003

Ushbu maqoladagi misollar va istiqbol birinchi navbatda Amerika Qo'shma Shtatlari bilan muomala va vakili emas a butun dunyo ko'rinishi mavzuning. (2010 yil dekabr) (Ushbu shablon xabarini qanday va qachon olib tashlashni bilib oling) |

- Ushbu maqola neft bozoriga ta'sir qiluvchi voqealar xronologiyasidir. Xuddi shu davrdagi energetik inqirozni muhokama qilish uchun qarang 2000-yillardagi energiya inqirozi. Hozirgi yoqilg'i narxlari uchun qarang Benzindan foydalanish va narxlari.

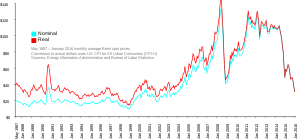

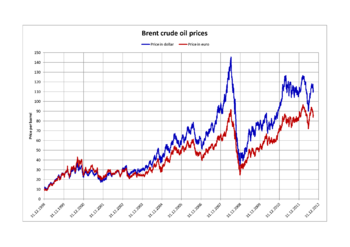

1980-yillarning o'rtalaridan 2003-yil sentyabriga qadar inflyatsiya a narxini to'g'irladi bochka xom neft NYMEX barreli uchun odatda $ 25 dan past bo'lgan. Keyin, 2004 yil davomida narx 40 dollardan, keyin esa 60 dollardan oshdi. Bir qator tadbirlar natijasida 2005 yil 11-avgustga qadar narx 60 dollardan oshib ketdi va 2006 yil o'rtalarida 75 dollargacha ko'tarilgan rekord tezlashuvga olib keldi. Keyin narxlar 2007 yil boshida 60 dollar / barrelgacha pasayib, yana keskin ko'tarildi. 2007 yil oktyabr oyida 92 dollar / barrelgacha, dekabrdagi fyucherslar uchun 99,29 dollar / barre Nyu York 2007 yil 21-noyabrda.[1] 2008 yilning birinchi yarmida neft muntazam ravishda rekord darajada yuqori narxlarga erishdi.[2][3][4][5] Nyu-York tovar birjasida avgust oyida etkazib berish uchun 2008 yil 27 iyundagi narxlar barreli uchun 141,71 dollarni tashkil etdi. Liviya ishlab chiqarishni qisqartirish tahdidi va OPEK Prezidentning taxmin qilishicha, narxlar 170 dollarga yetishi mumkin Shimoliy yoz.[6][7] Bir barreli uchun eng yuqori qayd etilgan narx, maksimal 147,02 dollarga, 2008 yil 11-iyulda erishilgan.[8] 2008 yil yozining oxirida 100 dollardan pastga tushgandan so'ng, sentyabr oyining oxirida narxlar yana ko'tarildi. 22 sentabrda neft 25 dollardan 130 dollargacha ko'tarilib, yana 120,92 dollarga o'rnashdi va rekord bir kunlik daromad 16,37 dollarni tashkil etdi. Elektron narxdagi neft savdosi NYMEX tomonidan narxning kunlik o'sish chegarasi 10 dollarga etganida vaqtincha to'xtatildi, biroq chegara bir necha soniyadan so'ng tiklandi va savdo qayta tiklandi.[9] 16 oktyabrga kelib narxlar yana 70 dollardan pastga tushib ketdi va 6 noyabrda neft 60 dollardan pastga yopildi.[10] So'ngra 2009 yilda narxlar biroz oshib ketdi, garchi 2005-2007 yillardagi inqiroz darajasida bo'lmasa ham, 2011 yilda va 2012 yilning aksariyat qismida 100 dollardan oshdi. 2013 yil oxiridan boshlab neft narxi 100 dollardan pastga tushib, bir yilda 50 dollardan pastga tushib ketdi. keyinroq.

Neft ishlab chiqarish narxi sezilarli darajada ko'tarilmaganligi sababli, narxlar oshishi neft sanoati uchun rekord darajada foyda keltiradigan davrga to'g'ri keldi.[iqtibos kerak ] 2004 yildan 2007 yilgacha oltitaning foydasi supermajorlar – ExxonMobil, Jami, Qobiq, BP, Chevron va ConocoPhillips - jami $ 494,8 mlrd.[11] Xuddi shunday, neftga bog'liq bo'lgan yirik mamlakatlar Saudiya Arabistoni, Birlashgan Arab Amirliklari, Kanada, Rossiya, Venesuela va Nigeriya 2000 yillar davomida neft narxining ko'tarilishidan iqtisodiy foyda ko'rdilar.

G'arbiy Texas oraliq nefti va Brent nefti o'rtasidagi farq AQSh neftining miqdori yuqori bo'lsa, ko'proq bo'ladi, shuning uchun neftni bozordan chiqarish uchun narxlar pasayadi.[12]

2003

Qo'shma Shtatlar 2003 yilda neftning turli xil neft ishlab chiqaruvchi davlatlaridagi siyosiy beqarorlik tufayli bir barreli o'rtacha 30 dollarni tashkil etdi va 2002 yildagi o'rtacha narxdan 19 foizga o'sdi.[13] The 2003 yil Iroqqa bostirib kirish neft bozorlari uchun muhim voqea bo'ldi, chunki Iroq katta miqdordagi globalni o'z ichiga oladi neft zaxiralari.[14] Mojaro global miqyosda neftga bo'lgan talabning oshishi bilan bir vaqtda yuz berdi, ammo bu Iroqning hozirgi neft qazib olish hajmini kamaytirdi va neft narxining oshishiga sabab bo'ldi.[15] Biroq, neft kompaniyasining bosh direktori Metyu Simmons ta'kidlaydi tepalik va pasayish neft eksporti Meksika, Indoneziya va Birlashgan Qirollik uchun sababdir narxlarni ko'tarish. Simmonsning so'zlariga ko'ra,[16] Iroq urushi kabi izolyatsiya qilingan hodisalar qisqa muddatli narxlarga ta'sir qiladi, ammo uzoq muddatli tendentsiyani belgilamaydi. Simmons foydalanishni keltirib chiqaradi yaxshilangan neftni qayta tiklash Meksika kabi yirik sohalardagi texnikalar Kantarell,[16] oxir-oqibat pasayguncha bir necha yil ishlab chiqarishni saqlab qoldi. Iroqdan neftni haydab chiqarish qisqa vaqt ichida neft narxini pasaytirishi mumkin, ammo narxni doimiy ravishda pasaytira olmaydi. Simmons nuqtai nazaridan Iroqqa bostirib kirish neft narxlarining uzoq muddatli ko'tarilishining boshlanishi bilan bog'liq, ammo bu mumkin pasayishni yumshatish Iroq neft zaxiralarining qisman miqdorini saqlab qolish orqali neft qazib olishda. To'g'ridan-to'g'ri natija sifatida neft qazib olish quvvati 2 million barrelgacha (320 000 m) kamaydi3) kuniga.[17]

2004 yildan 2008 yilgacha: neft narxining ko'tarilishi

2004 yil oxiri va 2005 yil boshlarida bir necha oy orqaga chekingandan so'ng, xom neft 2005 yil mart oyida narxlar eng yuqori darajaga ko'tarildi. Narx bo'yicha NYMEX yuqorida bo'lgan $ 2005 yil 5 martdan beri bir barrel uchun 50 dollar. 2005 yil iyun oyida xom neft narxi bir barreli uchun 60 dollar bo'lgan psixologik to'siqni buzdi.

2005 yildan boshlab xom neft bozorida narxlarning egiluvchanligi sezilarli darajada o'zgardi. 2005 yilgacha neft narxining ozgina ko'tarilishi ishlab chiqarish hajmining sezilarli darajada kengayishiga olib keldi. Keyinchalik narxlarning ko'tarilishi ishlab chiqarishni faqat oz sonli o'sishiga imkon beradi. Bu 2005 yilni eng yuqori nuqta deb atash uchun sabab bo'ldi.[18]

Vayron qilinganidan keyin Katrina bo'roni Qo'shma Shtatlarda benzin narxi 2005 yil sentyabr oyining birinchi haftasida rekord darajaga etdi. O'rtacha chakana narx o'rtacha, $ AQSh galloniga 3,04.[19] Bir litrning o'rtacha chakana narxi benzin ichida Birlashgan Qirollik 2006 yil 19 oktyabrda 86,4 p ni tashkil etdi yoki bir galon uchun 6,13 dollar.[20] Iroqda neft qazib olish xalqning qazib olinishi natijasida pasayishda davom etdi davom etayotgan ziddiyat baravariga (160000 m) qazib olish hajmining pasayishiga olib keladi3/ d).[21]

2006 yil o'rtalarida xom neft 79 dollardan oshiqroq narxda sotildi bochka (barbl),[22] hamma vaqt rekordini o'rnatish. Tayyorgarlik benzin iste'molining 1,9 ga ko'payishi, geosiyosiy keskinlik tufayli yuzaga keladi Shimoliy Koreya raketa uchirish. Davom etayotgan Iroq urushi, shuningdek Isroil va Livan urushga kirishmoqda Shuningdek, sababchi omillar hamdir. 2006 yilda neftga bo'lgan talabning o'sishi, shu jumladan neftga bo'lgan talabning pasayishi bilan jahon neft talabining o'sishini sezilarli darajada pasaytirdi. OECD.[23] 2006 yil 9-oktabrda Shimoliy Koreyaning muvaffaqiyatli yadro sinovini o'tkazgani haqidagi xabardan so'ng, neft narxi bir barreli uchun 60 dollardan oshdi, ammo ertasi kuni pasayib ketdi.

2007 yil 19 oktyabrda AQSh engil xom sharqda davom etayotgan keskinliklar kombinatsiyasi tufayli barreli uchun 90,02 dollarga ko'tarildi kurka va kamaytiradigan kuch AQSh dollari.[24] Narxlar AQSh xom neft zaxiralarining ko'payishini kutganligi sababli qisqa vaqt ichida pasayib ketdi, ammo ular tezda 2007 yil 26 oktyabrda 92,22 dollarga ko'tarildi.[25]

2008 yil 2 yanvarda AQSh engil xom Yangi yil kunidagi keskinlik tufayli bir barreli uchun 100 dollardan oshib, 99,69 dollarga tushdi Nigeriya va AQSh xomashyo zaxiralari ketma-ket ettinchi haftada pasayishiga shubha bilan qaraldi. A BBC keyingi kundan hisobotda bitta treyder narxni taklif qilganligi ko'rsatilgan; Stiven Schork, sobiq qavat savdogari Nyu-York savdo birjasi va neft bozori yangiliklari muharriri, dedi ulardan biri pol savdogari 1000 barrel (160 m) sotib oldi3), ruxsat etilgan eng kichik miqdor va darhol uni 600 dollar zarar bilan 99,40 dollarga sotdi.[26] 4-yanvar, juma kuni savdolar yopilayotganda, ishsizlar soni oshganligini ko'rsatadigan zaif ish o'rinlari hisoboti tufayli neft hafta oxirida yana pasayib, 97,91 dollarga tushdi.[27]

2008 yil 5 martda, OPEK ayblangan Qo'shma Shtatlar neft narxlarini rekord darajaga ko'targan, ishlab chiqarishni ko'paytirishga qaratilgan chaqiriqlarni rad etgan va "aybdorlarni aybdor" deb hisoblagan iqtisodiy "noto'g'ri boshqaruv" ning Jorj V.Bush ma'muriyati.[28] Neft narxi 110 dollardan oshib, inflyatsiyani to'g'irlagan yangi rekordni 2008 yil 12 martda 109,92 dollarga ko'tarilishidan oldin oshirdi.[29] 2008 yil 18 aprelda Nigeriya jangari guruhi neft quvuriga hujum qilganini da'vo qilgandan keyin neft narxi barreli uchun 117 dollarni tashkil qildi.[30] Yoqilg'i narxi 2008 yil 22 aprelda barreli uchun 119,90 dollardan yuqori darajaga ko'tarildi,[31] suvga cho'mishdan oldin, keyin esa 3 AQSh dollari ko'tarilib, 2008 yil 25 aprelda Nyu-York savdo birjasida 119,10 dollarga ko'tarilib, AQSh harbiy Sealift qo'mondonligi tomonidan shartnoma tuzilgan kemaning Eron qayig'iga qarata o'q uzgani haqidagi xabardan keyin.[32]

6 iyun kuni narxlar 24 soat ichida 11 dollarga ko'tarildi, bu Isroilning Eronga hujumi ehtimoli tufayli tarixdagi eng katta yutuq.[33] Ikkita yirik neft etkazib beruvchilarning kombinatsiyasi etkazib berishni kamaytiradi, bu takrorlanish qo'rquvini keltirib chiqardi 1973 yilgi neft inqirozi. Saudiya Arabistonining iyul oyi o'rtalarida neft qazib olishni ko'paytirish to'g'risidagi qarori narxlarga unchalik katta ta'sir ko'rsatmadi. Eron Islom Respublikasi neft vaziri G'ulom-Xusseyn Nozarining so'zlariga ko'ra, jahon bozorlari to'yingan[34] va Saudiya Arabistoni ishlab chiqarishni ko'paytirish haqidagi va'dasi narxlarni pasaytirmaydi.[35] Osiyoning bir nechta neftni qayta ishlash zavodlari iyun oyi oxirida Saudiya neftidan bosh tortishdi, chunki narxlari oshib ketdi sinf.[36]

3-iyul kuni " Brent Shimoliy dengiz Osiyo savdosida avgust oyida etkazib beriladigan xom neft shartnomasi barreli uchun 145,01 AQSh dollarigacha ko'tarildi.[37] Londonning "Brent" markali nefti barreli uchun rekord darajaga - 145,75 dollarga yetdi va avgustga etkazib beriladigan "Brent" markali neft Londonning ICE Futures birjasida rekord darajaga - $ 145,11 ga, NYMExchange birjasida - 144,44 dollarga ko'tarildi.[38][39] Kunduzi Evropada NYMEda bir barreli 145,85 dollarga ko'tarildi, ICE Futures birjasida Brent markali neftning bir barreli 146,69 dollarni tashkil etdi.[40][41]

2008 yil: neft narxi 145,85 dollarga ko'tarilib, so'ng eng pasti 32 dollarga yetdi

2008 yil 15 iyulda Prezident Bushning neftni burg'ilashga qo'yilgan taqiq bekor qilinadi degan so'zlaridan bir kun oldin pufakchalar yorilib sotila boshlandi.[42] Bu $ 8 pasayishiga olib keldi, bu o'shandan beri eng katta narx birinchi AQSh-Iroq urushi. Hafta oxiriga kelib, AQSh va Eron o'rtasidagi ziddiyatlarning yumshashi ham ta'sir ko'rsatgan holda, neft 11 foizga pasayib, 128 dollarni tashkil etdi.[43] 13 avgustga kelib narxlar barreli uchun 113 dollarga tushdi.[44] Sentyabr oyining o'rtalariga kelib, neft narxi olti oy ichida birinchi marta 100 dollardan pastga tushdi,[45] oqibatida 92 dollardan pastga tushib ketdi Lehman birodarlar bankrotlik.[46]

AQSh dollarining kuchayishi va Evropadagi talabning pasayishi pasayish sabablari bo'lishi mumkinligi aytilgan.[47] 24-oktabrga qadar xom neft narxi 64,15 dollarga tushdi,[48] va 6-noyabr kuni 60,77 dollardan yopildi.[10] 2008 yil dekabr oyi oxiriga kelib neft 32 dollarga tushdi.

2009

2009 yil yanvar oyida neft narxi vaqtincha ko'tarilganligi sababli G'azo sektoridagi keskinliklar.[49] Yanvar oyining o'rtalaridan 13 fevralgacha neft bir barreli uchun 35 dollarga yaqinlashdi.[50]

2010

2010 yil 21 mayda neft narxi asosan ikki hafta ichida 88 dollardan 70 dollarga tushdi, asosan Evropa davlatlari byudjet kamomadini qanday kamaytiradi degan xavotir tufayli; agar Evropa iqtisodiyoti pasaygan bo'lsa, bu xom neftga talabning kamayishini anglatadi. Shuningdek, agar Evropa iqtisodiy inqirozi Amerika iqtisodiyotini muammolarga olib keldi, neftga bo'lgan talab yanada kamayadi.[51] Boshqa omillar orasida kuchli bo'lganlar ham bor edi dollar va yuqori zaxiralar. Ga ko'ra AQSh Energetika bo'yicha ma'muriyati, 10-may kuni butun mamlakat bo'ylab benzin narxi o'rtacha 2,91 dollarni tashkil qildi, ikki haftadan so'ng 2,79 dollarga tushdi. The Deepwater Horizon neftining to'kilishi quduq qazilmagani uchun gaz narxlarida omil bo'lmadi.[52]

2010 yil dekabr oyida narxlar 90 dollar / barrelgacha ko'tarildi.[53] AQShda 87 oktanli doimiy qo'rg'oshinsiz o'rtacha bir gallon 23 dekabr kuni o'rtacha 3.00 dollar / gallonni tashkil etdi, agar narxlar 2011 yil bahorida kutilganidek 100 dollar / barreli va 4.00 dollarga yetganda ikkinchi turg'unlik qo'rquvi paydo bo'ldi.[iqtibos kerak ] Dekabr oyida narxlar oshishi global talab va Arktikadagi portlashlarga ta'sir qildi Shimoliy Amerika va Evropa.

2011–2013

2011

Siyosiy tartibsizlik Misr, Liviya, Yaman va Bahraynda 2011 yil fevral oyi oxirida neft narxi 95 dollarga / barrelgacha ko'tarildi. Bir necha kun oldin NYMEX neft narxi 86 dollardan yopildi. 24 fevral kuni neft narxi 103 dollardan oshib ketdi, bu erda neftni ishlab chiqarish siyosiy g'alayonga chek qo'yildi Liviya.[54]

Yoqilg'i ta'minoti yuqori darajada saqlanib qoldi va Saudiya Arabistoni to'xtashga qarshi kurashish uchun ishlab chiqarishni ko'payishiga ishontirdi. Shunga qaramay, O'rta Sharq va Shimoliy Afrika inqirozi neft narxlarining so'nggi ikki yil ichida eng yuqori darajaga ko'tarilishiga olib keldi, keyinchalik benzin narxi. Liviya neftining aksariyati Evropaga ketgan bo'lsa-da, barcha neft narxi bunga munosabat bildirdi. Qo'shma Shtatlarda benzinning o'rtacha narxi 6 sentga o'sib, 3,17 dollarni tashkil etdi.[55] 2011 yil 1 martda Liviyada ishlab chiqarish hajmining sezilarli darajada pasayishi va boshqa mamlakatlarda beqarorlikning paydo bo'lishidan qo'rqish Nyu-York savdolarida neft narxining barreli uchun 100 dollardan oshishiga olib keldi, gazning o'rtacha narxi esa 3,37 dollarga yetdi. Saudiya va'dalariga qaramay, nordon yog ' eksport qilingan mamlakat istalgani o'rnini bosa olmadi shirin Liviya yog'i.[56] 2011 yil 7 martda benzinning o'rtacha narxi 3,57 dollarni tashkil etib, jismoniy shaxslar transport vositalarida o'zgarishlarni amalga oshirmoqdalar.[57]

Zaiflashib ketgan AQSh dollari barreliga barreli 112 dollarga / milliardga etdi va o'rtacha 3.74 dollar / galonni tashkil etdi - AQSh iqtisodiyotiga zarar etkazishi kutilganidek, uzoq muddatli turg'unlik.[58] 26-aprel holatiga ko'ra, o'rtacha mamlakat o'rtacha 3.87 dollarni tashkil etdi - bu yozgi haydash mavsumi oldidan mamlakat bo'ylab o'rtacha $ 4 / galondan qo'rqish bilan.[59]

Xom neft 2-may kuni 114,83 dollarga yetdi, bu 2008 yil sentyabridan beri eng yuqori ko'rsatkichdir.[60], 2011 yil 5-may kuni benzin uchun o'rtacha o'rtacha 44-kun ko'tarilib, 3,98 dollarga yetdi. Biroq, o'sha kuni, G'arbiy Texas oralig'i xom[61] 9 foizga tushib ketdi,[60] kunni barreli uchun 100 dollardan pastroqda tugatdi, bu 16 martdan beri eng past[61] ikki yil ichida eng dramatik bir kunlik pasayishdan keyin. 6-may kuni benzin narxi biroz pasayib ketdi va mutaxassislar yozgacha bir galonni 3,50 dollarga kutishdi.[60][62][63]

Iyun oyi o'rtalarida G'arbiy Texas oraliq nefti iyulga etkazib berish uchun qariyb 2 dollarga tushib, 93,01 dollarni tashkil etdi, bu fevraldan beri eng past narx. Dollar ko'tarildi va evro va boshqa valyutalar pastga, va Evropa iqtisodiy inqirozi investorlarni tashvishga solib qo'ydi. London Brent nefti 81 sentga tushib, 113,21 dollarga tushdi. 15 iyun kuni Energiya Axborot Uyushmasi neft iste'moli o'tgan yilga nisbatan 3,5 foizga kamayganini aytdi, ammo benzin ulgurji savdosi bir necha hafta ichida birinchi marta ko'tarildi. 17 iyun kuni gaz narxi bir gallonni 3,67,5 dollarni tashkil etdi, bu avvalgi oyga nisbatan 25,1 tsentga past, ammo bir yil oldingi ko'rsatkichga nisbatan 96,8 tsentga teng.[64] 24-iyun kuni gaz narxi 3,62,8 dollarni tashkil etdi va ochilishi sababli ancha arzonlashadi Strategik neft zaxirasi. AQSh neft narxi yana ko'tarilishidan oldin 90 dollardan pastga tushdi va Brent nefti 2 foizga tushdi.[65]

Avgust oyida aktsiyalar narxining pasayishiga sabab bo'lgan xuddi shu pessimistik iqtisodiy yangiliklar ham kutilayotgan energiya talabini pasaytirdi.[66] 8 avgustda neft 6 foizdan oshib, may oyidagi eng katta pasayish bilan 81 dollarga tushdi, bu yilning eng past narxi.[67]

Oktyabr davomida neft narxi 22 foizga o'sdi, bu fevral oyidan beri eng yuqori sur'at, chunki AQSh iqtisodiyoti bilan bog'liq xavotirlar kamayib, 2012 yil boshiga kelib 4 dollar prognozlariga olib keldi. 8-noyabr holatiga ko'ra bu narx 96,80 dollarga yetdi. Iqtisodiyotdan kelib chiqadigan talabning pasayishi, sayohatlarning normal pasayishi, boshqa mamlakatlarda neft narxining pasayishi va arzon narxlardagi qishki qorishmalar ishlab chiqarilishi tufayli benzin narxi o'sishni kuzatmadi. O'rtacha bir oz ko'tarilib, 3,41 dollarni tashkil etdi.[68]

2012

CIBC global neft sanoati xom neft bozorida turg'unlikka qaramay, katta miqdordagi neft ishlab chiqarishni davom ettirayotganligini xabar qildi. Dan neft qazib olish Bakken shakllanishi 2012 yilda har yili 2016 yilgacha 600 ming barrelga o'sishi prognoz qilingan edi. 2012 yilga kelib Kanadaning qattiq neft va neft qumlarini ishlab chiqarish hajmi ham keskinlashdi.[69]

Agar shunday bo'lsa, neft tanqisligi paydo bo'lishi mumkin edi Eron yopildi Hormuz bo'g'ozi, bu orqali eksport qilinadigan neftning beshdan biri sayohat qiladi sanktsiyalar tufayli mamlakat yadro siyosati. Yoqilg'i ta'minoti borasidagi xavotirlar va Evropaning qarzdorligi sababli neft narxi yanvar oyi davomida 100 dollarga yaqin turdi. Gazning o'rtacha narxi 20 yanvar kuni 3,38 dollarni tashkil etdi, bu o'tgan oyga nisbatan 17 sentga ko'pdir.[70][71] Fevral oyining boshiga kelib, o'rtacha benzin uchun milliy o'rtacha narx 3,48 dollarni tashkil etdi, ammo neft narxi 98 dollarni tashkil etdi, bu olti haftadagi eng past ko'rsatkich va AQSh talabi 2001 yil sentyabr oyidan beri eng past ko'rsatkich edi.[72] 20-fevralda benchmark mart xomashyosi 105,21 dollarga yetdi, bu to'qqiz oy ichida eng yuqori ko'rsatkichdir. Bu Eron neft vazirligi Britaniya va Frantsiya kompaniyalariga sotish tugaganligini e'lon qilganidan bir kun keyin sodir bo'ldi; garchi bu ta'minotga ozgina ta'sir ko'rsatsa-da, qo'rquv narxlarning oshishiga olib keldi. Shuningdek, tasdiqlash Gretsiyani qutqarish rejasi kutilgan edi va Xitoyning pul taklifini oshirish bo'yicha harakati iqtisodiyotni rag'batlantirishi mumkin edi.[73] Brent nefti yil davomida 11 foizga o'sib, 17 fevralda 119,58 dollarni tashkil qildi, Evropada sovuq havo va undan yuqori Uchinchi dunyo talab va G'arbiy Texas oralig'i xom neft 19 foizga oshib, 103,24 dollarni tashkil etdi. Gazning o'rtacha narxi 3,53 dollarni tashkil etdi.[74]

24 aprelda benzin bir yil avvalgi 3,86 dollarga nisbatan 3,85 dollarni tashkil etdi; gaz narxi o'tgan yilga nisbatan past bo'lganiga ikki yil bo'ldi. Xom neft narxi pasaygan; G'arbiy Texasning bir barreli 103,55 dollarni tashkil etdi,[75] mart oyi oxirida 107 dollardan oshgan,[76] va Brent Crude $ 118,16[75] mart oyida 128 dollardan yuqori darajaga ko'tarilgandan so'ng.[77]

2011 yil oktyabr oyidan beri eng past narxga tushganidan so'ng, Benchmark nefti 29 iyun kuni 5,8 foizga o'sib, 82,18 dollarni tashkil etdi, Brent nefti 4,5 foizga o'sib, 95,51 dollarni tashkil etdi. Evropani qutqarish bo'yicha harakatlar banklarga qarz berish, muvaffaqiyatsizliklar ehtimolini kamaytirish. Shuningdek, Evropa mamlakatlari Eron neftini sotib olmaslikka qaror qilishdi. Gaz narxi 3,35 dollarni tashkil etdi, bu 6-yanvardan beri eng past narx.[78]

7 avgust kuni Kaliforniyadagi neftni qayta ishlash zavodida sodir bo'lgan yong'in neft fyuchersining sakrashiga hissa qo'shdi. Neftni qayta ishlashning boshqa muammolari, quvurning oqishi, Erondan qo'rqish, Suriyadagi inqiroz, Shimoliy dengiz muammolar va Ernesto tropik bo'roni barchasi olti hafta ichida neft narxining 20 foizga sakrashiga hissa qo'shdi. Gaz narxi 3,63 dollarga yetdi, ammo undan yuqori ko'tarilishi kutilmagan edi.[79] Qo'shma Shtatlardagi yaxshi iqtisodiy yangiliklar neftning 17-avgustdan beri eng yuqori narxga ko'tarilishiga hissa qo'shdi, Benchmark Crude 96,01 dollarga yetdi, Brent nefti esa bir oz pasayib, 113,71 dollarga tushdi.[80]

Dekabr oyi o'rtalarida gaz narxi 3,25 dollarga yetdi, bu 2012 yildagi eng past ko'rsatkichdir.[81] Neft 84 dollardan 90 dollargacha sotilayotgan edi.[82]

2013

17 yanvar kuni Qo'shma Shtatlarda yaxshi iqtisodiy yangiliklar bilan Benchmark nefti sentyabrdan beri eng yuqori darajaga ko'tarilib, 95 dollardan oshdi. Brent 110 dollardan oshdi.[83] 25-fevral kuni Evropa fond bozorlarida yaxshi natijalarga erishilganligi sababli, aprel oyida Benchmark xomashyosi o'tgan haftadagi sezilarli pasayishdan so'ng 94 dollardan oshdi, chunki Federal rezerv zaxira choralarini tugatishi va dollarni kuchaytirishi mumkin. Brent 115 dollardan oshdi.[84] Aprel oyining o'rtalariga kelib, salbiy iqtisodiy yangiliklar tufayli talabning pastligi kutilmoqda, Brent iyul oyidan beri eng past narx - 103,04 dollarga tushdi.[85]

10-iyul kuni neft ta'minoti pasayishi natijasida neft narxi bir yildan oshiq vaqt ichida eng yuqori ko'rsatkichga aylandi Misrdagi muammolar. O'tgan haftada Brent 7 foizga ko'tarilib, 108,51 dollarni tashkil etdi. Infratuzilmani boshqarish uchun juda ko'p miqdordagi neft ishlab chiqarilganligi sababli, G'arbiy Texas oralig'i bir necha yil davomida Brent-dan past edi; u Brent bilan izchil bo'lishiga qaytdi.[86][87]

28 avgustda G'arbiy Texas oraliq mahsuloti 110,10 dollarga yetdi, bu 2011 yil may oyidan beri eng yuqori ko'rsatkich, Brent esa 116,61 dollarga yetdi, bu AQShning aralashuvidan xavotir tufayli 19 fevraldan beri eng yuqori ko'rsatkich. Suriya. Ayni paytda Qo'shma Shtatlardagi zaxiralar to'rt oy ichida eng katta o'sishga erishdi.[88]

Liviyadagi muammolar va Eronga qarshi sanktsiyalar tufayli 13-noyabr kuni Brent 107,12 dollarga yetdi va West Texas Intermediate-dan 13,24 dollarga yuqori bo'ldi, bu apreldan buyon eng katta farq.[89]

27-dekabr kuni Qo'shma Shtatlarda iqtisodiyotning yaxshilanishi va talabning oshishiga olib kelishi sababli neft oktyabr oyidan beri birinchi marta taxminan 100 dollarni yopdi. Gaz 3,27 dollarni tashkil etdi, bu bir yil avval ikki tsentga past edi.[90]

2014–2016

2014

Sovuq ob-havo neft narxining fevral oyining katta qismida 100 dollardan yuqori bo'lishiga olib keldi, ammo arzonroq narxlar kutilgandi. Qo'shma Shtatlarning to'rtinchi chorakdagi iqtisodiy o'sishi erta taxmin qilinganidan past bo'lishi kutilganligi sababli, Benchmark nefti 27 fevral kuni biroz pasayib, 102,40 dollarga tushdi, Brent nefti esa 108,61 dollarga yetdi.[91]

Ukraina muammolari[92] 12 may kuni Benchmark neftini 100 dollardan, Brent neftini 108 dollardan oshirib yubordi,[93] Liviyadagi boshqa muammolar Benchmark xomashyosini 15 mayga qadar 102 dollardan va Brent neftini 110 dollardan oshirishga yordam berdi.[94][95] Ukraina va Liviya bilan bog'liq xavotirlarning davom etishi neftni 104 dollardan oshib ketdi.[96]

2014 yil iyun oyida AQShning qattiq neft (slanets moyi) ishlab chiqarish hajmi oshgani va Xitoy va Evropaning neftga bo'lgan talabining pasayishi sababli xom neft narxi uchdan bir qismga kamaydi. Jahon miqyosidagi haddan tashqari katta miqdordagi ta'minotga qaramay, 2014 yil 27-noyabrda Venada Saudiya neft vaziri Ali al-Naimi OPEKning kambag'al a'zo davlatlari, masalan, Venesuela, Eron va Jazoir kabi mamlakatlarning ishlab chiqarishni qisqartirish haqidagi murojaatlarini to'sib qo'ydi. Brent 71,25 AQSh dollarigacha tushib ketdi, bu to'rt yillik eng past ko'rsatkichdir. Al-Naimi bozor o'zini to'g'rilash uchun qoladi, bu AQShdagi slanetslarni sinish operatsiyalarini kamaytirishga bosim o'tkazishini ta'kidladi. OPEKda "qadimgi narxlarni himoya qilish siyosati" mavjud edi. OPEK AQShning qattiq neft (slanets moyi) ishlab chiqarilishini sekinlashtirish uchun Brent nefti narxining 60 dollargacha pasayishiga yo'l qo'yishga tayyor edi.[97] A'zo mamlakatlardagi iqtisodiy ahvolga qaramay, al-Naimi 2014 yil 10 dekabrda Saudiya Arabistonining harakatsizligi haqidagi bayonotini takrorladi.[98] 2014 yil oxiriga kelib, jahon miqyosida neft iste'moliga bo'lgan talabning pasayishi davom etar ekan, Shimoliy Dakotada "engil, qattiq" neft qazib olishda neft qazib olishning juda tez o'sishi. Bakken, Permian va Eagle Ford Texas shtatidagi havzalar, "AQShning neftni qayta ishlash, neft-kimyo va tegishli transport sohalari, temir yo'l va quvur tarmoqlari, xalqaro neft bozorlarini beqarorlashtirgan" iqtisodiy o'sishni yangilaydi.[99]

12-dekabrga kelib, Brent ham, WTI ham 2009 yildan beri eng past narxlarga erishdi; Brent bir barreli uchun 62,75 dollarga tushdi va WTI 58,80 dollarga tushdi.[100] Keyinchalik oyda neft narxi aprel oyidan beri 50 foizga pasaygan. Evropa va Osiyodagi iqtisodiy muammolar, yuqori gaz masofasi, kuchli dollar, AQShning yuqori ishlab chiqarilishi va OPEKning hech qanday harakati hisobga olinmadi.[101]

2015

Ga binoan Bloomberg Business, samaradorligi [102] ishlatadigan yangi zichroq (slanets moyi) quduqlari Qo'shma Shtatlarda gidravlik sinish Quduqni burg'ilash va qurish uchun sarflanadigan 12 million AQSh dollari miqdoridagi xarajatlar bilan bir qatorda, neft ishlab chiqaruvchilarni xom neftni saqlash cheklovlariga qaramay, allaqachon chaqqon bozorni arzon narxdagi neft bilan to'ldirishni davom ettirishga turtki berdi.[102] Ko'proq samaradorligi past va unumdorligi past bo'lgan quduqlarning ishi to'xtatildi, ammo bu qattiq neft (slanetsli neft) quduqlari qazib olish hajmini oshirishda davom etmoqda va xom neft narxi bir barreli 50 AQSh dollarigacha bo'lgan bozorda foyda keltiradi.[102]

Tomonidan oylik sharhning nashr etilishi Neft eksport qiluvchi mamlakatlarning tashkiloti Qo'shma Shtatlarda neft qazib olish cho'qqisiga chiqqanligi va uchinchi chorakda pasayishni boshlashi va shu bilan butun dunyo miqyosidagi xom ashyoni engillashtirishi haqida xabar berdi.[103]

Mart oyida neft olti yillik eng past ko'rsatkichga erishgandan so'ng,[104] Brent nefti aprel oyida 16 foizga o'sdi va 16 aprelda 64,95 dollarga yetdi, bu 2015 yildagi eng yuqori narx edi. 17 aprelda AQSh nefti 56,62 dollarni tashkil qildi. Sabablari AQSh va AQShda kutilgan qattiq neft (slanets moyi) ishlab chiqarishning pasayishi edi. Yamandagi urush.[105]

10 iyun kuni West Texas Intermediate 61,43 dollarga yetdi, bu dekabrdan beri eng yuqori narx. Talab yuqori darajada qolishi kutilgandi, ammo OPEKning ishlab chiqarish hajmi ham yuqori darajada saqlanib qoldi. Brent 65,70 dollarni tashkil etdi.[106][107]

AQSh dollari kuchli bo'lganligi, ta'minot miqdori yuqori bo'lganligi va Xitoy fond bozori pasayganligi sababli neft iyul oyida taxminan 10 dollarga tushdi. Oy oxiriga yaqin Brent nefti 53,31 dollarga yetib, olti oydagi eng past ko'rsatkichga yaqinlashdi, AQSh nefti esa 48,52 dollar bilan to'rt oylik eng past ko'rsatkichga yaqinlashdi.[108]

Avgust oyi davomida Brent eng past ko'rsatkichi - 42,23 dollarni, AQSh nefti esa 37,75 dollarni tashkil etdi.[109] So'ngra AQSh nefti 3 kun ichida 28% ga ko'tarildi, bu 1990 yildan beri eng yuqori ko'rsatkichdir. Brent nefti ham bir oy ichida eng yuqori ko'rsatkich bo'lgan $ 54 dan 28% ga ko'tarildi.[110]

Xalqaro energetika agentligining kelgusi yilga yuqori etkazib berishni bashorat qilganidan so'ng, AQSh nefti so'nggi ikki oy ichida bir hafta ichida eng ko'p pasayib, 15-oktabr kuni 47 dollardan pastga tushdi va Brent nefti deyarli ikki oy ichida bir hafta davomida eng katta yo'qotishlarga duch keldi 16-oktabr kuni 50 dollargacha.[111] Yaqin Sharq mamlakatlari ehtiyojidan ko'proq neft qazib olayotgan bir paytda, Eron buning natijasida yanada ko'proq neft qo'shishini kutmoqda yadroviy kelishuv, shuningdek, Xitoyda sekin o'sish bilan birga, 19-oktabrda AQSh nefti 46 dollardan pastga tushdi va 20 oktyabr boshida Brent nefti 48,51 dollarga yetdi.[112]

Dekabrning birinchi haftasida Brent 42,43 dollarga tushib ketdi va OPEK birinchi navbatda ishlab chiqarishni ko'paytiramiz, deb aytgandan so'ng, o'zgarishlarni amalga oshirmaslikka qaror qilganidan keyin AQSh nefti 40 dollardan pastga tushdi. Boshqa omillar zaif dollar va kuchli evro edi.[113]

21 dekabrda Brent bir barreli uchun 36,35 dollarga tushdi; bu 2004 yil iyulidan beri eng past narx edi.[114] 30 dekabr kuni AQSh ta'minoti hali ham yuqori bo'lib, engil shirin neft 36,60 dollarga tushdi, Brent nefti esa 36,46 dollarga yetdi. Neft yilni 30 foizga pasaytirdi.[115]

2016

2016 yil 6 yanvarda WTI neftining narxi o'n bir yillik eng past darajaga etdi, chunki u 2009 yildan beri birinchi marta barreli uchun 32,53 dollarga tushdi.[116] 12 yanvar kuni, ettinchi yutqazish kunida, neft 2003 yil dekabridan beri birinchi marta 30 dollardan pastga tushdi.[117] OPEK ishlab chiqarishni qisqartirishni rag'batlantirdi, bu esa narxlarning ko'tarilishiga yordam berdi[118] AQSh nefti 26,05 dollarga tushguncha, bu 2003 yil may oyidan beri eng past narx. OPEK "hamkorlik qilishga tayyor" bo'lganida narxlar ko'tarila boshladi.[119][120]

7 iyun kuni Benchmark nefti 21 iyuldan beri birinchi marta 50 dollardan oshdi.[121]

Avgust oyining boshida WTI 41,52 dollarga tushdi; neft narxi iyun oyidan beri 20% dan ko'proq tushib ketgan va hafta boshida ko'tarilgan.[122] OPeK ishlab chiqarishni cheklaydi degan umid bilan avgust oyida neft 11 foizga ko'tarilgandan so'ng, AQSh nefti 1 sentabrda 43,16 dollarga tushdi, bu oxirgi 3 hafta ichidagi eng past ko'rsatkichdir.[123]

26 sentyabr kuni OPEK yig'ilishi[124] ishlab chiqarishni qisqartirish to'g'risida qaror qabul qildi, natijada aprel oyidan beri neft narxlarida eng katta yutuqlar paydo bo'ldi.[125] 10-oktabr kuni Rossiya OPEK va Jazoirga qo'shilishni rejalashtirayotgani sababli, boshqalar "Brent" nefti bir yil ichidagi eng yuqori ko'rsatkichga erishib, 53,73 dollarni tashkil etdi, WTI esa 51,60 dollarni tashkil qildi, bu 9 iyundan beri eng yuqori ko'rsatkichdir.[126] Ammo OPEK a'zolari va a'zo bo'lmagan davlatlarning 29-oktabrdagi uchrashuvidan so'ng, 30-noyabr kuni yana uchrashish to'g'risida kelishuvga erishilgandan so'ng, neft pasayib ketdi.[127]

Saudiya Arabistoni OPEKning boshqa davlatlarini uning rejasida ishtirok etishga ishontirishga urinishni boshladi. OPEK davlatlari 30 noyabrda yig'ilishdi va 2008 yildan beri birinchi marta ishlab chiqarishni cheklashga kelishib oldilar. Natijada Brent nefti bir oy ichida eng yuqori ko'rsatkich bo'lgan 50 dollardan oshdi, G'arbiy Texas oralig'i esa atigi 50 dollarga yetmay to'xtadi.[128][129]

12-dekabr kuni Brent 57,89 dollarga, AQSh nefti esa 54,51 dollarga yetdi, bu 2015 yilning iyulidan buyon eng yuqori ko'rsatkich, chunki Rossiya va OPEK tarkibiga kirmaydigan boshqa mamlakatlar ham ishlab chiqarishni cheklashga kelishib oldilar.[130] 27-dekabr kuni mahsulotning pasayishi bilan 1-yanvardan boshlab Brent nefti 56,09 dollarni tashkil qildi va AQShning CLc1 nefti 53,90 dollarga yetdi.[131] neft haftaning oxirida biroz pasaygan bo'lsa-da, WTI yilni 45% daromad olish uchun yilni 53,72 dollarda, Brent esa 56,82 dollarni tashkil etib, 52% ga o'sdi. Ikkala yutuq ham 2009 yildan beri eng ko'p yutuq bo'ldi.[132][133]

2017–2019

2017

Boshqa mamlakatlar ishlab chiqarish hajmini pasaytirish va'dalariga qaramay, o'zgarishlarga oid dalillar ko'rilmadi. AQSh ishlab chiqarish hajmi yuqori bo'lib, neft pasayishda davom etdi.[134] AQSh ishlab chiqarishi va tovar-moddiy zaxiralari o'sib borayotganligi sababli, hatto pastroq dollar va OPEK davlatlari tomonidan ishlab chiqarilgan mahsulotlarning pasayishi ham neft narxlarini iloji boricha ko'tarilishiga olib kelmadi. WTI 26-yanvar kuni 53,07 dollarga, Brent nefti 55,44 dollarga yetdi.[135][136]

Xom-ashyo zaxiralari rekord o'rnatdi, shu sababli neft mart oyigacha pasayishda davom etdi, WTI 47 dollardan sal ko'proq, Brent esa 50 dollardan pastga tushdi.[137] Saudiya Arabistoni 2017 yilning birinchi yarmidan pastroq qazib olishni davom ettirish rejalarini e'lon qilganidan so'ng, aprel oyida neft yuqori darajaga ko'tarildi[138] pastroq ishlab chiqarishni davom ettirish rejalariga qaramay yana tushishdan oldin.[139] Iyun oyida OPEKning ishlab chiqarish hajmi o'sdi[140] va dunyo bo'ylab yuqori ta'minot va AQShda yuqori ishlab chiqarish bilan neft iyun oyida olti oy ichida eng past darajaga yetdi.[141] AQSh talabining oshishi va tovar-moddiy zaxiralarning pasayishi bilan neft oxir-oqibat aylanib, 9 avgustda ikki yarim oy ichida eng yuqori darajaga yetdi.[142][143][144]

Brent iyun-oktyabr oylarida 40% ga o'sdi, chunki neft ishlab chiqaruvchilari quyi ishlab chiqarishni davom ettirishlari kerak edi, uchinchi chorakda 20% ga o'sdi, bu 2004 yildan buyon chorakda eng yuqori ko'rsatkich bo'lib, sentyabrning so'nggi haftasida 59,49 dollarga yetdi. O'sish ko'proq bo'lar edi, lekin kurka natijasida quvurni yopib qo'yish tahdidiga amal qilmadi Kurdiston mustaqillik uchun ovoz beradi..[145] AQShning neft zaxiralari mart oyidan beri 15 foizga pasaygan va 2016 yilga nisbatan past bo'lgan, chunki WTI eksporti yuqori bo'lganligi sababli Brentga nisbatan ancha past bo'lgan.[146] Noyabr oyida WTI 57,92 dollarga yetdi, bu 2015 yil iyulidan beri eng yuqori ko'rsatkichga, Brent nefti esa 64,65 dollarga ko'tarilib, 2015 yil iyun oyidan beri eng yuqori ko'rsatkichga aylandi. Talab yuqori bo'lib, OPEKning pasayishi va "siyosiy ziddiyatning ko'tarilishi" boshqa sabablar bo'ldi.[147] 2017 yilning so'nggi haftasida WTI 2015 yil iyunidan beri birinchi marta 60 dollardan oshib, 59,69 dollarga tushdi, Brent nefti esa 2015 yil mayidan beri birinchi marta 67 dollardan o'tib, 66,50 dollarga tushdi. Liviya va Shimoliy dengizdagi quvurlar muammolari OPEK va Rossiya tomonidan ishlab chiqarishni qisqartirishga qo'shildi.[148]

2018

Ham WTI, ham Brent nefti 2014 yildan beri birinchi marta yilni 60 dollardan yuqori darajada boshladi.[149] AQSh zaxiralari bilan so'nggi uch yil ichida eng past ko'rsatkich va sovuq havo AQShda ishlab chiqarishni kamaytirgan holda, neft yanvar oyining o'rtalarida 2014 yil dekabridan beri eng yuqori narxga erishdi. 15 yanvar kuni Brent nefti 70,37 dollarga yetdi, ertasi kuni WTI 64,89 dollarni tashkil qildi. AQShda ishlab chiqarish oshdi va qish tugashi bilan talab pasayishi bashorat qilingan edi, shuning uchun narxlar tushdi.[150]

WTI mart oyini 64,94 dollar bilan yakunladi, bu oyda 5,6% va birinchi chorakda 7,7%. Brent oylik 8.6% va chorak uchun 6.3% o'sish uchun 70.27 dollarni tashkil etdi. Eronga nisbatan mumkin bo'lgan sanktsiyalar, OPEKning narxlarni ko'tarish istagi va Venesuelada ishlab chiqarishni pasayishi sabab bo'ldi.[151]

11-aprel kuni Qo'shma Shtatlar javoblarni rejalashtirish bilan Douma kimyoviy hujumi ichida Suriya fuqarolar urushi, WTI kunni 66,82 dollar bilan yakunladi, Brent esa 72,04 dollarni tashkil etdi, bu 2014 yil dekabridan beri eng yuqori ko'rsatkich.[152] May oyida WTI uch yarim yil ichidagi eng yuqori darajaga ikki marta erishdi. Brent ketma-ket oltinchi haftada ko'tarildi, bu 2011 yildan beri eng yuqori ko'rsatkich bo'lib, bir kun oldin 2014 yilning noyabridan beri birinchi marta 80 dollardan oshdi.[153]

OPEKning 2018 yil oxirigacha ishlab chiqarishni past darajada ushlab turishini e'lon qilishi bilan, WTI 30-may kuni 68.21 dollarni tashkil etdi. Brent 77,50 dollarda yakunladi. WTI va Brent o'rtasidagi farq, ehtimol qattiq yog '(slanets moyi) tufayli ortib bormoqda.[154]

WTI 2018 yilning birinchi yarmini taxminan 23 foizga, 74,15 dollargacha yakunladi, bu 2014 yilning noyabridan beri eng yuqori ko'rsatkich, ikkinchi chorakda 14 foizga va oy davomida 11 foizga o'sdi. Brent nefti 79,44 dollarni tashkil etdi. Liviyadan etkazib beriladigan mahsulotlarga tahdidlar va Erondan neft import qiladigan mamlakatlarga nisbatan sanktsiyalar taklif qilingan.[155]

Noyabr oyida neft so'nggi o'n yil ichida har oy uchun eng ko'p tushdi. WTI 50.93 dollarni tashkil etdi, bu hafta davomida 1% ga o'sdi, lekin oyda 22% ga kamaydi, Brent esa yiliga 12% ga pasayib, 58.71 $ ni tashkil etdi. AQSh, Rossiya va OPEKning ayrim mamlakatlarida yuqori ishlab chiqarish ta'minotni haddan tashqari oshirishni anglatardi. Yo'qotishlar ko'proq bo'lishi mumkin edi, agar OPEKni qisqartirish haqidagi taxminlar bundan mustasno.[156]

21 dekabrda yakunlangan hafta davomida WTI 11,4% ga pasayib, 45,59 dollarni tashkil etdi, bu 2017 yil iyul oyidan beri eng past ko'rsatkich, Brent nefti esa 10,7% ga pasayib, 53,82 dollarni tashkil etdi, bu 2017 yil sentyabr oyidan beri eng past ko'rsatkichdir. AQSh foiz stavkalari, AQShning faol neft konlari, AQShda xomashyo ishlab chiqarishning yuqori darajasi Dunyo miqyosida kutilgan talabning pastligi OPEK davlatlari tomonidan ishlab chiqarishni qisqartirishni bekor qilmadi, shu jumladan Saudiya Arabistonining aniq rejalari.[157]

Brent 2018 yilni 20 foizga pasaytirdi.[158]

2019

Neft yanvarni 18,5 foizga (1984 yildagi eng yaxshi ko'rsatkich) WTI bilan noyabrdan beri eng yuqori natijaga erishganidan bir kun keyin 53,79 dollarga, Brent esa oyiga 15 foizga ko'tarilib, 61,89 dollarga ko'tarildi; ikkala yutuq ham 2016 yil aprelidan beri bir oy davomida eng ko'p yutuq bo'ldi.[159] Saudiya Arabistoni tomonidan kutilayotgan ishlab chiqarishni qisqartirish haqida e'lon qilish muhim omil bo'ldi, ammo AQShdagi yuqori benzin zaxiralari neftni yanada yuqori darajaga ko'tarilishiga to'sqinlik qildi. AQShning xomashyo ta'minoti kutilganidan past edi va sanktsiyalar qo'llanildi Venesuela ham o'z hissasini qo'shdi.[160]

WTI fevral oyida 6,4 foizga o'sdi, Brent nefti esa 6,7 foizga ko'tarildi. 1 mart kuni WTI haftaning oxiriga 2,5 foizga pasayib, 55,80 dollarni tashkil etdi, Brent nefti esa 1,9 foizga pasayib, 65,07 dollarni tashkil etdi. OPEKning ishlab chiqarish hajmi so'nggi to'rt yil ichida eng past darajaga etgan bo'lsa ham, bu haqiqat edi. AQShning iqtisodiy hisobotlari o'sishning sekinlashuvidan dalolat berdi.[161]

Aprel oyining uchinchi haftasi WTI 64 dollar bilan yakunlandi va 2014 yil fevralidan beri birinchi marta ettinchi daromadga erishdi. Brent to'rtinchi haftada ko'tarilib, 71,97 dollarni tashkil etdi.[162] 22 aprelda WTI 66,30 dollarga ko'tarildi, oktyabr oyidan beri eng yuqori hisob-kitob natijasi Tramp ma'muriyati Eron neftini eksport qilishdan voz kechishni tugatish AQSh prezidenti Donald Tramp tvit yozdi bu farqni boshqa mamlakatlar tashkil qilishi. WTI AQSh xomashyo ta'minotining yuqoriligi sababli tushib ketgan bo'lsa-da, Brent 24 aprelda oktyabrdan beri eng yuqori yopilishga erishdi va ertasi kuni 74,35 dollarga tushdi.[163][164]

Trumpning Xitoydan import qilinadigan bojlarni oshirishni rejalashtirmoqda hissa qo'shdi[165] chunki WTI uch hafta davomida to'g'ri tushdi.[166] 23 mayda neft dekabrdan beri bir kun ichida eng ko'p tushganda (shuningdek, 200 kunlik harakatlanuvchi o'rtacha ko'rsatkichdan pastga tushdi), WTI 57,21 dollar bilan yakunlandi, 12 martdan beri eng past ko'rsatkich WTI 7 foizga yo'qotgan haftada; Brent haftani qariyb 5 foiz yo'qotish bilan 68,69 dollarda yakunladi. Haftaning pasayishi butun yil davomida eng ko'p bo'lgan. Xitoy bilan savdo urushi tashvish tug'dirdi, ammo Trampning mumkin bo'lgan harakatlari 24 mayda biroz yordam berdi.[167]

WTI 21 iyun bilan yakunlangan haftada deyarli 9 foizga o'sdi, bu 2016 yil dekabridan beri eng yuqori ko'rsatkich bo'lib, 57,43 dollarga yetdi, bu oyning eng yuqori ko'rsatkichi. Brent 5 foizga ko'tarilib, 65,20 dollarni tashkil etdi. Sakrash sabablari kutishlarni o'z ichiga olgan Federal zaxira foiz stavkalarini pasaytirish va Eron dronni urib tushirmoqda.[168]

WTI 1 avgustda 7,9 foizga pasaygan, bu to'rt yil ichida eng yuqori ko'rsatkich bo'lib, 53,95 dollarni tashkil qildi, bu 19 iyundan beri eng past ko'rsatkich edi. Ertasi kuni WTI Trampning qo'shimcha tariflar rejalariga javoban haftani pastga tushirdi. Brent 1 avgustda 7 foizga tushib ketdi va haftani ham pastroq yakunladi.[169] Later in the month, Tom Kloza, global head of energy analysis at the Oil Price Information Service, said this was proof a presidential tweet could affect world markets.[170]

On August 19, the difference between WTI and Brent was $3.53, the lowest since July 2018. At the start of the year it was twice that. More pipeline capacity was a reason. The Xitoy - AQSh savdo urushi was not a factor. As of September 5 WTI was up 24 percent to $56.30 while Brent increased 13 percent to $60.95.[171]

As of November 25, Brent was up 19 percent for the year.[158]

2020

On January 3, 2020, WTI finished up 2.2 percent for the week at $63.05, the highest since May, after U.S. air strikes in Iraq, with Brent up 2.6 percent for the week at $68.60.[172] Then oil fell for five straight days before rising again; the U.S. "backed away from military confrontation" with Iran, and stockpiles were higher. WTI fell 6.4 percent for the week, the most since July, and on January 13 had its lowest close since December 3 at $58.08. Brent fell 5.3 percent, the most since August, and then reached its lowest close since December 12 with $64.20.[173][174]

On February 10, oil reached its lowest level in over a year, with the Covid-19 pandemiyasi a major reason. WTI fell 1.5 percent to $49.57, the lowest since January 2019, and Brent dropped 2.2 percent to $53.27, the lowest since December 2018. Russia had not agreed to further production cuts, though OPEC had a plan.[175] Despite a forecast for lower demand, expectations of OPEC action led to three days of gains, with WTI reaching $51.42 and Brent $56.34.[176] WTI ended February 28 down more than 16 percent for the week, the most in 11 years, falling 5 percent to $44.76 on February 28. Brent closed at $50.52. Both were the lowest since December 2018. Warmer than usual weather was one reason but the major factor was concerns about economic slowdown due to COVID-19.[177][178]

Davomida 2020 yil Rossiya - Saudiya Arabistoni neft narxlari urushi, on March 8 oil fell over 30 percent. WTI reached $31.13, down 24.6 percent, with Brent $34.36, down 24.1 percent. Both were the lowest since 2016 and the one-day decline was the largest since 1991.[179] On a week when oil fell the most since 2014, Russia rejected plans by OPEC and others to help calm the oil market, and Saudi Arabia was expected to increase production.[180]

With worldwide demand continuing to decline due to COVID-19, oil fell for a fifth straight week at the end of March and any actions taken by Saudi Arabia or Russia would be inconsequential. During the last full week of March WTI fell about 5 percent to end at $21.51, with Brent down 7.6 percent for the week to $24.93.[181] The price of Canadian heavy crude dipped below $5 per barrel.[182]

In the first quarter, the percentage loss was the worst ever, 66.5 percent for WTI and 65.6 percent for Brent. Then on April 2, WTI jumped 24.7 percent to $25.32 and Brent rose 21 percent to $29.94, the biggest percentage increase in a single day ever, in anticipation of significant production cuts.[183] OPEC agreed to production cuts on April 12; these would be greater in 2020 than in future years. U.S. crude supplies had risen for 12 weeks, including the largest increase for a week as of April 10. On April 14, the difference between the front month contract and contracts for later delivery were the most since 2009 for WTI, which traded $14.45 below the September contract. On April 17, May WTI was $18.27 but June WTI was $28.08. For Brent, the June contract was $28.08 while October was $35.95. The difference between the two was less because Brent did not require as much storage capacity.[184] On April 20, the front month contract for WTI fell below zero, an unprecedented event. With the contract for May delivery expiring on April 21, the contract for June delivery became the new front month contract; on April 22 after settling at $13.78, WTI was the lowest since the 1990s.[185]

On May 6 WTI fell after five days of increases, settling at $23.99 a day after a 20 percent jump to the highest close since April 17 with expectations of higher demand as countries around the world eased restrictions. Brent finished at $29.72 a day after a 14 percent jump. U.S. crude inventories were up for the 15th week, but by less than expected.[186]

On May 21, WTI settled at $33.92 and Brent at $36.06, both the highest since March 10. U.S. crude supplies were down for the second week, and OPEC production was down. Positive economic news from Europe and the United States also contributed, although possible tensions with China limited gains.[187]

WTI fell more than 8 percent on June 11, the most since April 27, and ended the week at $36.26 with its first down week in seven weeks. WTI and Brent both ended the week down over 8 percent. OPEC production cuts could not overcome COVID-19 concerns.[188] For the week ending June 19, WTI climbed nearly 10 percent to $39.75 as OPEC made sure countries were complying with goals for output decreases.[189] WTI fell nearly 6 percent June 24 then rose slightly the next day to close at $38.72, while Brent fell more than 5 percent and rose slightly to $41.05, in a week where both have fallen nearly 3 percent. Some U.S. states were delaying reopening, and others were going back to lockdowns. Also, U.S. supplies climbed for the third week while U.S. crude production was down 20 percent since early March. OPEC nations were continuing their production cuts. A negative forecast for the world economy also affected oil prices.[190]

On July 15, after the largest drop in U.S. crude supplies of the year, WTI reached $41.20 and Brent $43.79, the highest since March 6 for both.[191] That same day, OPEC and others said they planned to decrease production cuts in August but FXTM analyst Lukman Otunuga said it might not be the time for that given the chances of more COVID-19 related lockdowns or problems with the world economy.[192]

The first week of August ended with WTI up 2.4 percent to $41.22 and Brent up 2 percent to $44.40. Production cuts took effect on August 1 but U.S. president Trump signed executive orders which added to tensions with China and helped drive prices down.[193]

In the third week of August Brent fell 1 percent to $44.35, while WTI ended the week at $42.34 after the number of U.S. oil rigs rose after falling for three weeks. COVID-19 concerns have led to expectations of lower demand.[194]

Low demand for oil in the U.S., lower U.S. unemployment, a strong AQSh dollari and losses in the stock market contributed to WTI falling nearly 4 percent on September 4 to $39.77, the first time below $40 since July. WTI ended the week down 7.5 percent after four up weeks, and Brent finished the week at $42.66, down nearly 7 percent. Demand for gasoline had recovered more quickly than demand for other petroleum products, and Michael Tran of RBC Capital said supplies fell at a "manic pace" over two months. Other products still had high inventories.[195] Bad news about U.S. unemployment, a strong dollar, lower expected demand, and higher U.S. crude supplies contributed to the second down week for WTI, which fell 6.1 percent to $37.33. Brent fell 6.6 percent for the week to $39.83. This was the first time oil fell for two straight weeks since April.[196]

For the week ending September 25, oil fell for the third time in four weeks due to COVID-19 concerns, fear that the U.S. recovery will slow down, and a higher U.S. dollar. WTI ended at $40.25, down 2.6 percent, and Brent was down 2.9 percent, with the most active contract ending at $42.41.[197]

Natijada U.S. President Donald Trump being diagnosed with COVID-19, WTI fell 4.3 percent on October 2 to finish the week down 8 percent at $37.05, the lowest since September 8. Brent dropped 4.1 percent and 7.4 percent for the week to $39.27, the lowest since June 12. Continued concerns about the pandemic reducing demand also contributed even as U.S. supplies fell.[198] An increase in U.S. inventories and an end to negotiations on COVID-19 relief in the U.S. contributed to another drop on October 7, with WTI down to $39.95 and Brent at $41.51.[199]Increased imports from China helped oil rise by 2 percent on October 13, and expected production cuts by OPEC and allies led to a continued rise on October 14 to $41.04 for WTI and $43.32 for Brent. COVID-19 cases and high inventories, however, made the trend unlikely to continue.[200]

Restrictions in Europe due to COVID-19 and expected delays for production cuts by OPEC and allies caused oil to rise November 2 for the first time in four trading days. WTI jumped from $33.64 to $36.81 and Brent rose from $35.74 to $38.97.[201]

WTI and Brent both reached their highest settlements since September on November 18, with WTI at $41.82 and Brent at $44.34. One major factor was good news about Covid-19 vaksinalari. U.S. crude inventories rose more than expected, and uncertainty about OPEC and COVID-19 lockdowns contributed to lower prices the next day.[202][203] Oldinroq Minnatdorchilik kuni, gas was $2.11, the lowest at that time of year since 2016 and 49 cents lower than a year earlier.[204]

Adabiyotlar

- ^ "Oil reaches new record above $99". BBC. 2007 yil 21-noyabr. Olingan 2007-11-29.

- ^ "Oil prices pushed to fresh high". BBC yangiliklari. 2008-02-29. Olingan 2009-12-31.

- ^ David Goldman (March 12, 2008). "Oil crosses record $110, despite supply rise". CNN Money. Olingan 2008-03-12.

- ^ John Wilen (March 10, 2008). "Gas Prices Near Records, Following Oil". Associated Press. Arxivlandi asl nusxasi 2008-03-13 kunlari. Olingan 2008-03-10.

- ^ "Oil sets fresh record above $109". BBC yangiliklari. 2008 yil 11 mart. Olingan 2008-03-11.

- ^ "Oil Is Little Changed After Falling as Investors Sell Contracts". Bloomberg.com. 2008 yil 27 iyun.

- ^ "Oil Rises to Record Above $141 as Investors Buy Commodities". Bloomberg.com. 2008 yil 27 iyun.

- ^ "Oil hits new high on Iran fears". BBC.com. 2008-07-11. Olingan 2009-12-31.

- ^ "Oil spikes $25 a barrel on anxiety over US bailout".

- ^ a b Rooney, Ben (November 7, 2008). "Oil holds slim gains". CNN. Olingan 21 aprel, 2010.

- ^ Global 500, Baxt website, accessed August 2008.

- ^ Myra P. Saefong (September 6, 2019). "Why U.S. crude has outpaced gains for the international oil benchmark this year". Bozor tomoshasi.

- ^ Oil prices in 2003 averaged highest in 20 years, USA Today

- ^ government, Robert Longley Robert Longley is a U. S.; since 1997, history expert with over 30 years of experience in municipal government He has written for ThoughtCo. "How Oil Influenced the 2003 US Invasion of Iraq". ThoughtCo.

- ^ Collier, Robert (2005-03-20). "Iraq invasion may be remembered as the start of the age of oil scarcity". San-Fransisko xronikasi. Olingan 2008-03-20.

- ^ a b Simmons, Matthew (2007-11-16). "Another Nail in the Coffin of the Case Against Peak Oil" (PDF). Arxivlandi asl nusxasi (PDF) 2008-04-11. Olingan 2008-04-05.

- ^ Youssef M. Ibrahim (2004-05-10). "The world has lost Iraq's oil". USA Today. Olingan 2008-03-20.

- ^ "James Murray, David King: Oil's tipping point has passed, Nature, Vol 481, 2012, p. 433-435" (PDF). Arxivlandi asl nusxasi (PDF) 2014-07-21. Olingan 2015-03-08.

- ^ "Weekly U.S. Retail Gasoline Prices, Regular Grade". Olingan 2006-09-26.

- ^ "Free UK Petrol Prices". Olingan 2007-11-29.

- ^ Krane, Jim (2006-04-28). "Iraq Oil Output Lowest Since Invasion". Vashington Post. Olingan 2008-03-20.

- ^ "My Stocks & Funds". CNN. Olingan 21 aprel, 2010.

- ^ "Finfacts: Irlandiya biznesi, iqtisodiyot bo'yicha moliya yangiliklari". www.finfacts.com.

- ^ Oil prices touch above $90 level, BBC yangiliklari

- ^ "BBC NEWS | Business | Supply fears push oil above $92". newsvote.bbc.co.uk.

- ^ Single trader behind oil record – http://news.bbc.co.uk/1/hi/business/7169543.stm

- ^ Shenk, Mark (January 4, 2008). "Oil Falls More Than $1 as U.S. Jobs Data Signal Lower Fuel Use". Bloomberg L.P.

- ^ "OPEC accuses U.S. on oil prices". CNN. 5 mart 2008 yil. Arxivlangan asl nusxasi 2008 yil 26 mayda.

- ^ "Oil Rises Above $110 to Record as the Dollar Falls Against Euro". Bloomberg. 2008 yil 12 mart.

- ^ "BBC NEWS | Business | Oil reaches $117 for first time". newsvote.bbc.co.uk.

- ^ "Oil nears $120". CNN Money. April 22, 2008. Archived from asl nusxasi 2008 yil 23 aprelda. Olingan 2008-04-22.

- ^ Zhou, Moming. "Oil jumps over $3 after report on U.S. shot toward Iran boat". MarketWatch.

- ^ Mouawad, Jad (June 7, 2008). "Oil Prices Take a Nerve-Rattling Jump Past $138" - NYTimes.com orqali.

- ^ Iran: World oil market saturated

- ^ Oil output increase will not affect price

- ^ Asia says no to extra Saudi crude

- ^ "Oil prices hit new peak above US$145".

- ^ "Bloomberg - Siz robotmisiz?". www.bloomberg.com. Cite umumiy sarlavhadan foydalanadi (Yordam bering)

- ^ "Oil tops $145 ahead of U.S. holiday". July 3, 2008 – via uk.reuters.com.

- ^ "ap.google.com, Oil prices near $146". Arxivlandi asl nusxasi 2008 yil 1 avgustda.

- ^ "This story is no longer available - Washington Times". www.washingtontimes.com.

- ^ "Bush lifts executive ban on offshore oil drilling". CNN. July 14, 2008.

- ^ "Oil sags to 6-week low as war worries ebb". Yosh. 2008 yil 18-iyul.

- ^ "Yahoo Finance - Stock Market Live, Quotes, Business & Finance News". finans.yahoo.com.

- ^ Lesova, Myra P. Saefong, Polya. "Oil tumbles more than 5%, but natural gas rebounds". MarketWatch.

- ^ "Bloomberg - Siz robotmisiz?". www.bloomberg.com. Cite umumiy sarlavhadan foydalanadi (Yordam bering)

- ^ Rooney, Ben (October 6, 2008). "Oil tumbles to 8-month low below $88". CNN. Olingan 21 aprel, 2010.

- ^ "Crude oil prices skid despite OPEC output cut". Arxivlandi asl nusxasi 2008-10-27 kunlari.

- ^ "Oil price rises on Gaza conflict". BBC. 2009 yil 5-noyabr. Olingan 2011-03-12.

- ^ "Oil languishes near $35 on weak US economy". Associated Press. 2009 yil 16-yanvar. Arxivlangan asl nusxasi 2013 yil 16-yanvarda. Olingan 2011-03-12.

- ^ Joseph Lazzaro (May 21, 2010). "Gas Prices Headed Lower as Summer Driving Season Heats Up". Kundalik moliya.

- ^ Andrew Maykuth (May 27, 2010). "Summer shocker: Gasoline prices going down". Filadelfiya tergovchisi.

- ^ Riley, Charles (December 23, 2010). "Gas prices top $3 a gallon". CNN. Olingan 23 dekabr, 2010.

- ^ Rooney, Ben (February 24, 2011). "Oil prices spike to $103, then drop back". CNN. Olingan 24-fevral, 2011.

- ^ Clifford Krauss and Christine Hauser (February 22, 2011). "Oil Soars as Libyan Furor Shakes Markets". The New York Times.CS1 maint: mualliflar parametridan foydalanadi (havola)

- ^ Clifford Krauss and Jad Mouawad (March 1, 2011). "Uncertainty Drives Up Oil Prices". The New York Times.CS1 maint: mualliflar parametridan foydalanadi (havola)

- ^ Jad Mouawad and Nick Bunkley (March 8, 2011). "U.S. Economy Is Better Prepared for Rising Gas Costs". The New York Times.CS1 maint: mualliflar parametridan foydalanadi (havola)

- ^ "Oil settles above $112 as dollar falls". Washington Times. Olingan 20 aprel, 2016.

- ^ [o'lik havola ]"Gasoline rises to $3.87 per gallon". Yahoo!. Olingan 26 aprel, 2011.

- ^ a b v Margot Habiby (May 2, 2011). "Oil Jumps to 31-Month High on Concern About Al-Qaeda Reprisals". Bloomberg Businessweek.

- ^ a b Chris Kahn (May 6, 2011). "Oil drops below $100 per barrel". Quyosh yangiliklari. Associated Press. Arxivlandi asl nusxasi 2013 yil 4 fevralda.

- ^ Jonathan Fahey and Chris Kahn (May 7, 2011). "Gas price to drop as oil joins plunge". Quyosh yangiliklari. Associated Press. Arxivlandi asl nusxasi 2013 yil 4 fevralda.CS1 maint: mualliflar parametridan foydalanadi (havola)

- ^ Blake Ellis (May 6, 2011). "Oil settles down 2.6%". CNNMoney.

- ^ Chris Kahn (June 18, 2011). "Oil falls 2 percent, to $93 a barrel". Quyosh yangiliklari. Associated Press. Arxivlandi asl nusxasi 2013 yil 4 fevralda.

- ^ "Price of gas drops 11 cents in the last two weeks". MSNBC. 2011 yil 26 iyun. Arxivlangan asl nusxasi 2011 yil 29 iyunda.

- ^ Chris Kahn (August 6, 2011). "Gas prices expected to fall". Quyosh yangiliklari. Associated Press.[doimiy o'lik havola ]

- ^ Robert Dominguez (August 9, 2011). "Gas prices fall to lowest price all year after stock values plummet". Nyu-York Daily News.

- ^ Chris Kahn (November 9, 2011). "Oil soars, but don't worry yet at the pump". Yangiliklar va kuzatuvchi. Associated Press.

- ^ "Why price discounts for Canadian crude are here to stay", Alberta Oil, 1 September 2012, archived from asl nusxasi 2014 yil 11 dekabrda, olingan 8 dekabr 2014

- ^ "Retail gasoline prices stay high on concerns about the Middle East and Europe". Vashington Post. Associated Press. January 20, 2012. Archived from asl nusxasi 2019 yil 22 sentyabrda.

- ^ "Iran: EU oil sanctions 'unfair' and 'doomed to fail'". BBC yangiliklari. 2012 yil 23-yanvar.

- ^ Gary Strauss (February 6, 2012). "Gas prices to jump". USA Today.

- ^ Pablo Gorondi (February 20, 2012). "Oil jumps to 9-month high after Iran cuts supply". Quyosh yangiliklari. Associated Press.[doimiy o'lik havola ]

- ^ Chris Kahn (February 20, 2012). "Gas prices are highest ever for this time of year". Yangiliklar va yozuvlar. Associated Press.

- ^ a b Chris Kahn (April 24, 2012). "US gasoline prices now cheaper than a year ago". Yahoo yangiliklari. Associated Press.

- ^ "2012 West Texas Intermediate Crude Oil (WTI) Prices". Birlik Tinch okeani. Olingan 2012-04-26.

- ^ Robert Gibbons (April 17, 2012). "UPDATE 9-US crude jumps, Brent lags, spread narrows". Reuters.

- ^ Chris Kahn (June 29, 2012). "Oil soars as Europe moves to bolster banks". Boston Globe. Associated Press.

- ^ Steve Hargreaves (August 7, 2012). "Gas prices climb 30 cents a gallon". CNNMoney.

- ^ Samantha Bomkamp (August 7, 2012). "Oil rises; U.S. considers release from reserves". Quyosh yangiliklari. Associated Press. Arxivlandi asl nusxasi 2012 yil 20 avgustda. Olingan 20 avgust, 2012.

- ^ "Oil rises on new hope of 'fiscal cliff' resolution; pump prices hit $3.25 a gallon, 2012 low". Washington Post. Associated Press. 2012 yil 17 dekabr. Arxivlangan asl nusxasi on December 18, 2012.

- ^ "Oil Prices Lifted by Progress on Fiscal Cliff Talks". Fox Business. Dow Jones Newswires. 2012 yil 17-dekabr.[o'lik havola ]

- ^ "Oil prices rise above $95 on strong US housing data and encouraging signs for job market". Washington Post. Associated Press. 2013 yil 17-yanvar. Arxivlangan asl nusxasi 2019 yil 2 sentyabrda.

- ^ Pablo Gorondi (February 25, 2013). "Oil price gains to above $94 on weaker dollar". Yangiliklar va kuzatuvchi. Associated Press.

- ^ Jonathan Fahey (April 13, 2013). "Oil Falls 2 Percent, Gas Prices to Keep Dropping". ABC News. Associated Press.

- ^ Steve Hargreaves (July 10, 2013). "Oil prices surge above $105, gasoline tops $3.50". CNNMoney.

- ^ Anna Louie Sussman (July 10, 2013). "Update 9-U.S. crude soars to 16-mth high; discount to Brent under $2". Reuters.

- ^ Grant Smith (August 29, 2013). "WTI Oil Falls From 2-Year High as Syria Strike Debated". Bloomberg yangiliklari.

- ^ Mark Shenk (November 13, 2013). "Crude Rises as Fuel-Price Gain Spurs Demand for Oil". Bloomberg yangiliklari.

- ^ Pablo Gorondi (January 2, 2014). "Oil price falls below $96". Yangiliklar va kuzatuvchi. Associated Press.

- ^ Pablo Gorondi (February 27, 2014). "Oil Down Ahead of Expected Trimming in US Growth". ABC News. Associated Press.

- ^ Pablo Gorondi (April 8, 2014). "Oil up Above $101 on Renewed Unrest in Ukraine". ABC News. Associated Press.

- ^ Pablo Gorondi (May 12, 2014). "Ukraine Jitters Push Crude Oil Above $100". ABC News. Associated Press.

- ^ "Oil below $102 on weak US economic data". Montana standarti. Associated Press. 2014 yil 15-may.

- ^ Pablo Gorondi (May 20, 2014). "Oil Steady Above $102 as Libya Tensions Flare". ABC News. Associated Press.

- ^ Pablo Gorondi (May 28, 2014). "Oil higher above $104 on crises in Ukraine, Libya". Associated Press.

- ^ Lawler, Alex; Sheppard, David; El Gamal, Rania (27 November 2014), Saudis block OPEC output cut, sending oil price plunging, Vienna: Reuters, olingan 10 dekabr 2014

- ^ Krishnan, Barani (10 December 2014), Oil crashes 5%, nears $60 on weak U.S. demand, Saudi inaction, London: Globe and Mail via Reuters, olingan 10 dekabr 2014

- ^ Mohr, Patricia (28 November 2014), Scotiabank Commodity Price Index (PDF), dan arxivlangan asl nusxasi (PDF) 2014-12-08 kunlari, olingan 8 dekabr 2014

- ^ "WTI Oil extends drop below $60 as IEA cuts forecast; Brent falls", Bloomberg yangiliklari, 2014 yil 12-dekabr, olingan 12 dekabr 2014

- ^ Chris Isidore (December 23, 2014). "89 straight days of lower gas prices". CNNMoney.

- ^ a b v "Why Cheap Oil Doesn't Stop the Drilling", Bloomberg, 5 March 2015, olingan 6 mart 2015

- ^ Friedman, Nicole (16 April 2015), "Oil Prices Hit a 2015 High on Hopes U.S. Production Will EaseLight, sweet crude for May delivery settled up 32 cents to $56.71 a barrel on the New York Mercantile Exchange", Wall Street Journal, Nyu York, olingan 16 aprel 2015

- ^ Nicole Friedman (August 6, 2015). "Oil Prices Near Six-Year Lows on Oversupply Fears". The Wall Street Journal.

- ^ Himanshu Ojha (April 17, 2015). "Brent rises above $64 after Yemen oilfield retreat". Reuters.

- ^ Myra P. Saefong and Georgi Kantchev (June 11, 2015). "Oil retreats from year's high, settles 1% lower". MarketWatch.

- ^ "Oil Prices Rise on Inventory Data". Fox Business. Dow Jones Newswires. 2015 yil 10-iyun. Arxivlangan asl nusxasi 2015 yil 12 iyunda. Olingan 12 iyun, 2015.

- ^ Barani Krishnan (July 30, 2015). "Oil dips as robust dollar offsets stock drawdown". Reuters.

- ^ Christopher S. Rugaber (September 16, 2015). "US oil surges 5.7% to settle at $47.15 a barrel". CNBC. Reuters.

- ^ "Global Oil Prices Jump as Equitiy Markets Rally". Fox Business. Reuters. 2015 yil 3 sentyabr. Arxivlangan asl nusxasi 2015 yil 25 sentyabrda. Olingan 23 sentyabr, 2015.

- ^ Koustav Samanta (October 16, 2015). "Oil inches higher in volatile trade after week's sharp losses". Reuters.

- ^ Christopher Johnson (October 20, 2015). "Oil steadies under $50 but outlook uncertain". Reuters.

- ^ "Oil below $40 a barrel as OPEC rolls over policy". CNBC. Reuters. December 4, 2015.

- ^ Benoit Faucon (December 23, 2015). "OPEC Report Suggests Oil-Price Rebound, Supply Cut". The Wall Street Journal.

- ^ Nicole Friedman (December 30, 2015). "Oil Prices Fall on Oversupply Anxiety". The Wall Street Journal.

- ^ "Oil price posts two-year highs - but how long can it last?". Buyuk Britaniya haftaligi.

- ^ Christopher Johnson (January 12, 2016). "Oil crashes to $30 a barrel". CNNMoney.

- ^ "Oil rises, pares losses in January on hopes for production deal". CNBC. Reuters. 2016 yil 29 yanvar.

- ^ Charles Riley (February 11, 2016). "Oil crash taking stocks down ... again". CNNMoney.

- ^ Matt Egan (February 12, 2016). "Crazily volatile oil spikes 12% in biggest gain since 2009". CNNMoney.

- ^ Marley Jay (June 8, 2016). "Late sell-off leaves stocks barely higher/oil rises". Salisbury Post. Associated Press. p. 2A.

- ^ "Oil prices fall as dollar jumps on US jobs data". CNBC. Reuters. August 5, 2016.

- ^ "US crude closes 3.45 pct lower, at $43.16, marking a 3-week low". CNBC. Reuters. 2016 yil 1 sentyabr.

- ^ Debbie Carlson (September 24, 2016). "Third time's the charm? Opec members meet again to tackle low oil prices". The Guardian.

- ^ Alison Sider and Sarah McFarlane (September 29, 2016). "Oil Prices Climb After OPEC Deal". The Wall Street Journal.

- ^ Barani Krishnan (October 10, 2016). "Oil hits one-year high as Russia ready to join output caps". Reuters.

- ^ Akin Oyedele (October 31, 2016). "Crude oil is getting slammed after another OPEC meeting flop". Business Insider. Reuters.

- ^ David Gaffen (November 21, 2016). "Oil jumps, at three-week high ahead of OPEC output decision". Reuters.

- ^ Devika Krishna Kumar and Jessica Resnick-Ault (December 1, 2016). "After OPEC deal, oil expected to rally – for the moment". Reuters.

- ^ "US crude posts best settle since July 2015, up 2.6% at $52.83 on oil producer output cuts". CNBC. Reuters. 2016 yil 12-dekabr.

- ^ David Gaffen (December 27, 2016). "Oil rallies in thin trade, adds to year's gains". Reuters.

- ^ Mark Tay (December 30, 2016). "Oil prices edge up despite unexpected U.S. crude inventory build". Reuters.

- ^ Ethan Lou (December 30, 2016). "Oil down, but ends year with biggest gain since 2009". Reuters.

- ^ Devika Krishna Kumar (January 13, 2017). "Oil falls on China concerns, down 3 percent for the week on China doubts". Reuters.

- ^ Naveen Thukral (January 24, 2017). "U.S. oil prices rise on weaker dollar, U.S. drilling in focus". Reuters.

- ^ Henning Gloystein (January 26, 2017). "Oil prices rise on weakening dollar, but plentiful supplies cap gains". Reuters.

- ^ Myra Saefong and Victor Reklaitis (March 22, 2017). "Oil ends lower, as drop in gasoline stocks softens blow of record U.S. supplies". MarketWatch.

- ^ Henning Gloystein (April 12, 2017). "Oil prices rise on prospect that Saudi Arabia seeking output cut extension". Reuters.

- ^ "US crude plunges 4.8% to $45.52, posting worst close in more than five months". CNBC. Reuters. 2017 yil 4-may.

- ^ Henning Gloystein (June 14, 2017). "Oil prices fall on OPEC output increase, rising U.S. crude stocks". Reuters.

- ^ Julia Simon (June 16, 2017). "Oil prices edge up; still near 2017 lows on stubborn glut". Reuters.

- ^ "US crude falls 1.1%, settling at $49.03, amid concerns about oil cartel's growing output". CNBC. Reuters. 2017 yil 3-avgust.

- ^ Scott DiSavino (August 4, 2017). "US crude falls 1.1%, settling at $49.03, amid concerns about oil cartel's growing output". Reuters.

- ^ Jane Chung (August 11, 2017). "Oil prices flat as oversupply concerns linger". Reuters.

- ^ Julia Simon (October 3, 2017). "Oil prices dip on profit-taking and U.S. production fears". Reuters.

- ^ "Oil prices edge up on signs of tightening market". Reuters. 2017 yil 20 oktyabr.

- ^ Scott DiSavino (November 10, 2017). "Oil prices slide after U.S. drillers add rigs". Reuters.

- ^ Henning Gloystein (December 28, 2017). "Oil prices near 2015 highs on tight market". Reuters.

- ^ "Oil marks highest January opening price since 2014". Reuters. 2018 yil 1-yanvar.

- ^ Henning Gloystein (January 19, 2018). "Oil prices drop on uptick in U.S. production". Reuters.

- ^ Myra P. Saefong and Sarah McFarlane (March 29, 2018). "Oil ends higher, notches third straight quarterly rise". Bozor tomoshasi.

- ^ Myra P. Saefong, Mark Decambre and Sarah McFarlane (April 11, 2018). "Oil settles at a more than 3-year high on Middle East tensions". Bozor tomoshasi.

- ^ Myra P. Saefong and Christopher Alessi (May 18, 2018). "Oil falls for the session, but U.S. benchmark logs 3rd weekly gain in a row". Bozor tomoshasi.

- ^ Myra P. Saefong and Mark DeCambre (May 30, 2018). "Oil prices rally, with U.S. crude notching the first gain in 6 sessions". Bozor tomoshasi.

- ^ Myra P. Saefong and Mark DeCambre (June 29, 2018). "Oil marks a fourth climb, with U.S. prices tallying a year-to-date gain of more than 20%". Bozor tomoshasi.

- ^ Myra P. Saefong and Rachel Koning Beals (November 30, 2018). "Oil prices drop 22% in November for biggest monthly loss in a decade". Bozor tomoshasi.

- ^ Myra P. Saefong and Rachel Koning Beals (December 21, 2018). "U.S. oil prices end at 17-month low, down more than 11% for the week". Bozor tomoshasi.

- ^ a b Rachel Koning Beals (November 25, 2019). "Oil gains, holds near 2-month high as looming OPEC meeting expected to yield deeper cuts". Bozor tomoshasi.

- ^ Myra P. Saefong and Rachel Koning Beals (January 31, 2019). "Oil gains, with U.S. prices up more than 20% for the month". Bozor tomoshasi.

- ^ Tom DiChristopher (January 9, 2019). "US crude surges 5.2%, settling at $52.36, on Saudi output cuts and US-China trade talks". CNBC.

- ^ Myra P. Saefong and Rachel Koning Beals (March 1, 2019). "Oil prices decline on demand concerns to lose roughly 3% for the week". Bozor tomoshasi.

- ^ Myra P. Saefong and Rachel Koning Beals (April 18, 2019). "U.S. oil futures notch a 7th straight weekly climb, the longest streak in 5 years". Bozor tomoshasi.

- ^ Myra P. Saefong and Rachel Koning Beals (April 23, 2019). "Oil adds to multimonth high as supply uncertainty drives crude prices". Bozor tomoshasi.

- ^ Myra P. Saefong and Rachel Koning Beals (April 25, 2019). "U.S. oil prices fall, Brent turns lower in pullback from recent multimonth highs". Bozor tomoshasi.

- ^ Myra P. Saefong and Barbara Kollmeyer (May 6, 2019). "Oil ends up as concerns over U.S.-China trade talks ease, Middle East tensions rise". Bozor tomoshasi.

- ^ Myra P. Saefong and Mark DeCambre (May 10, 2019). "Oil ends up as concerns over U.S.-China trade talks ease, Middle East tensions rise". Bozor tomoshasi.

- ^ Myra P. Saefong and Rachel Koning Beals (May 24, 2019). "Oil futures suffer worst weekly performance of the year". Bozor tomoshasi.

- ^ Myra P. Saefong and Rachel Koning Beals (June 21, 2019). "Oil logs 9% weekly rise — biggest since late 2016; refinery fire jolts gasoline futures". Bozor tomoshasi.

- ^ Rachel Koning Beals (August 7, 2019). "Oil resumes steep drop as U.S.-China trade row raises demand worries". Bozor tomoshasi.

- ^ Myra P. Saefong (August 24, 2019). "Gasoline prices may drop by another 10% before the year is done". Bozor tomoshasi.

- ^ Myra P. Saefong (September 6, 2019). "Why U.S. crude has outpaced gains for the international oil benchmark this year". Bozor tomoshasi.

- ^ Myra P. Saefong and William Watts (January 3, 2020). "Oil settles more than 3% higher after U.S. airstrike kills Iranian military commander". Bozor tomoshasi.

- ^ Myra P. Saefong and William Watts (January 13, 2020). "Oil prices fall for a fifth straight session". Bozor tomoshasi.

- ^ Myra P. Saefong and William Watts (January 14, 2020). "Oil prices settle higher for the first time in 6 sessions". Bozor tomoshasi.

- ^ Myra P. Saefong and William Watts (February 10, 2020). "Oil drops back to 1-year low as coronavirus takes toll on China crude demand". Bozor tomoshasi.

- ^ Myra P. Saefong and William Watts (February 10, 2020). "Oil drops back to 1-year low as coronavirus takes toll on China crude demand". Bozor tomoshasi.

- ^ Myra P. Saefong and William Watts (February 28, 2020). "U.S. oil futures suffer largest weekly percentage loss in over a decade". Bozor tomoshasi.

- ^ Myra P. Saefong and William Watts (February 27, 2020). "Oil finishes at lowest in over 13 months as coronavirus keeps market in 'stranglehold'". Bozor tomoshasi.

- ^ William Watts (March 9, 2020). "Why an 'oil shock' sent the Dow down 2,000 points and upended global financial markets". Bozor tomoshasi.

- ^ Mark DeCambre (March 8, 2020). "Oil plunges 25% and investors brace for a race to the bottom, as an all-out OPEC 'price war' erupts between Saudi Arabia and Russia". Bozor tomoshasi.

- ^ Myra P. Saefong and William Watts (March 27, 2020). "Plunge in global crude demand sends oil prices down for a 5th straight week". Bozor tomoshasi.

- ^ "Canadian heavy oil collapses another 28% to under $5 as oilsands face shut-ins | Financial Post". 27 mart 2020 yil. Arxivlandi from the original on 2020-03-30.

- ^ Myra P. Saefong and Barbara Kollmeyer (April 2, 2020). "Oil rallies, with U.S. prices up nearly 25% as Trump expects Saudi Arabia and Russia to cut production". Bozor tomoshasi.

- ^ Myra P. Saefong (April 18, 2020). "Oil market in 'super contango' underlines storage fears as coronavirus destroys crude demand". Bozor tomoshasi.

- ^ Mark DeCambre (April 22, 2020). "About 150-years of oil-price history in one chart illustrates crude's spectacular plunge below $0 a barrel". Bozor tomoshasi.

- ^ Mark DeCambre and Myra P. Saefong (May 6, 2020). "Oil futures settle lower on storage capacity concerns, despite a smaller-than-expected rise in U.S. crude supplies". Bozor tomoshasi.

- ^ Myra P. Saefong and Mark DeCambre (May 21, 2020). "Oil ends at six-week high on tighter supplies, demand prospects". Bozor tomoshasi.

- ^ Myra P. Saefong and Mark DeCambre (June 19, 2020). "Oil prices end slightly lower, post first weekly loss in 7 weeks". Bozor tomoshasi.

- ^ Myra P. Saefong (June 19, 2020). "Oil futures end higher, with U.S. prices up nearly 10% for the week". Bozor tomoshasi.

- ^ Myra P. Saefong and Mark DeCambre (June 25, 2020). "Oil prices settle higher after 2-session drop, but demand worries persist on coronavirus flare-up". Bozor tomoshasi.

- ^ Myra P. Saefong and William Watts (July 15, 2020). "Oil prices at 4-month high as U.S. crude supply posts biggest decline of the year and OPEC+ tapers output cuts". Bozor tomoshasi.

- ^ Myra P. Saefong and William Watts (July 17, 2020). "Oil settles lower, posting modest change for week as rise in coronavirus cases stokes demand worries". Bozor tomoshasi.

- ^ William Watts (August 7, 2020). "Oil lower as U.S.-China tensions mount, but logs weekly gain". Bozor tomoshasi.

- ^ William Watts (August 21, 2020). "Oil ends lower on demand worries". Bozor tomoshasi.

- ^ Myra Saefong and William Watts (September 4, 2020). "U.S. oil benchmark ends below $40 a barrel, down over 7% for the week". Bozor tomoshasi.

- ^ Myra Saefong and William Watts (September 11, 2020). "Oil prices suffer a second weekly fall on demand worries". Bozor tomoshasi.

- ^ Myra Saefong and William Watts (September 25, 2020). "Oil prices suffer a second weekly fall on demand worries". Bozor tomoshasi.

- ^ Myra Saefong and Barbara Kollmeyer (October 2, 2020). "Oil sells off after Trump's coronavirus diagnosis, sending U.S. prices down 8% for the week". Bozor tomoshasi.

- ^ "Oil falls nearly 2% on oversupply concerns". CNBC. Reuters. 2020 yil 7 oktyabr.

- ^ Myra Saefong and William Watts (October 14, 2020). "Oil prices finish higher, encouraged by OPEC+ commitment to output cuts". Bozor tomoshasi.

- ^ Myra Saefong and William Watts (November 2, 2020). "Oil ends higher as COVID Europe lockdowns feed expectations that OPEC+ may postpone output-cut curbs". Bozor tomoshasi.

- ^ Myra Saefong and William Watts (November 18, 2020). "Oil prices tally highest finish since early September on latest vaccine prospects". Bozor tomoshasi.

- ^ Myra Saefong and William Watts (November 19, 2020). "Oil posts a loss as rising COVID cases feed prospects for lower demand". Bozor tomoshasi.

- ^ Myra Saefong (November 21, 2020). "Thanksgiving could see almost half as many travelers, despite the lowest seasonal gas prices in 4 years". Bozor tomoshasi.